Vendor Reconciliation Format

Use accounting software to create your processional-looking vendor reconciliation format. Using Vyapar makes the entire process seamless and helps you manage your work with one app. You can download Vyapar now and access all reconciliation formats for free.

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

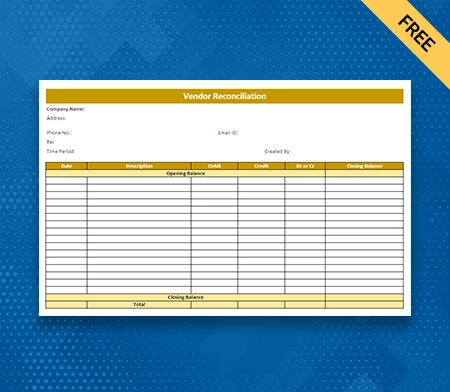

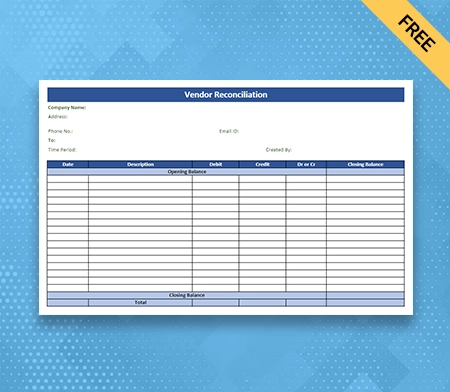

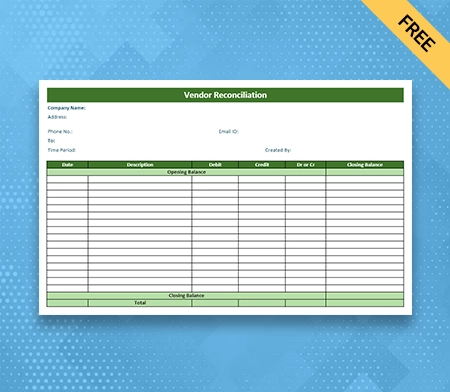

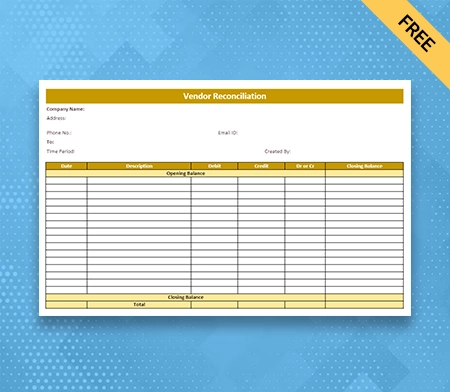

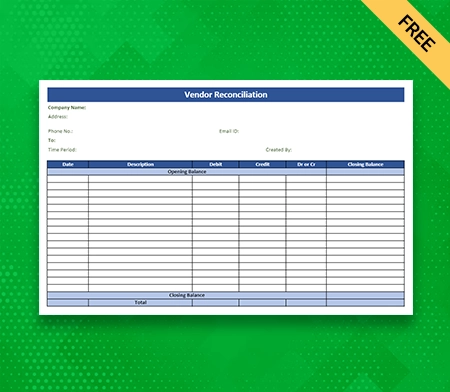

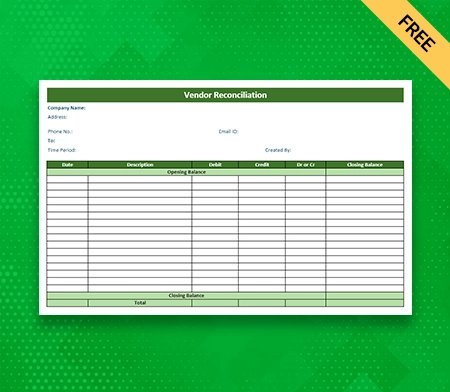

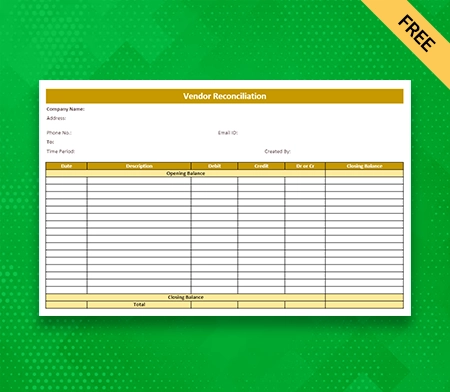

Free Vendor Reconciliation Format

What is the Vendor Reconciliation Format?

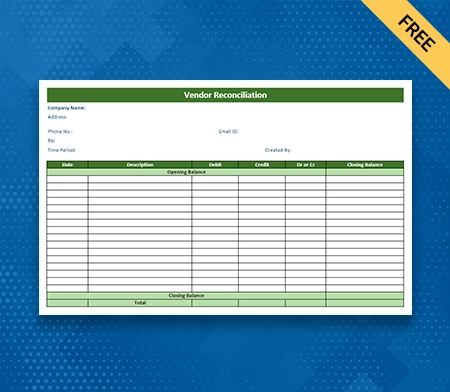

The Vendor Reconciliation Format in excel ,word and pdf is used as a standard structure or template that helps companies and suppliers compare and match their financial records. It usually includes invoice numbers, amounts, due dates or unpaid sums.

Businesses can use this format to ensure that their records match with their vendors, find and fix any differences or mistakes, and keep accurate financial records.

Steps to Perform Vendor Reconciliation

Here are the following steps to efficiently perform your vendor Reconciliation for your business:

1: Collect Vendor And Company Records

The first step in the vendor reconciliation format is to get the essential financial records from the vendor and your business. It includes getting bills, receipts, and information about payments. Get any receipts or proofs of delivery and invoices the vendor has sent for goods or services.

In the same way, get records of payments from your company, such as bank statements, check registers, or internet confirmations of payments. It is crucial to have a complete set of these financial papers to ensure the reconciliation process is accurate.

2: Compare Invoices And Payments

After getting your company’s vendor bills and payment information, the next step is to match each invoice with the payment that goes with it. Compare the transaction numbers, amounts, dates, and discounts or credits.

Once you receive all the essential information, you should ensure it is correct. It ensures that your company’s payments go to the right vendor bills. It makes a proper understanding of the financial transactions between your company and the vendor.

3: Identify Discrepancies

In the next step, you should thoroughly compare the vendor records with your company’s records to see any possible changes in this month or previous months. It would help to point out the missing invoices, as either you haven’t received them or forgot to pay.

You should also review the overpayments or underpayments, in which the amount paid differs from the amount billed. Also, watch for wrong amounts, dates, or deals that must be applied correctly. During the vendor reconciliation process, these studies help find any mistakes or discrepancies that need to be looked into further and fixed.

4: Investigate Discrepancies

It is critical to analyse the causes of inconsistencies discovered during vendor reconciliation to fix them. Contacting the vendor to address the discrepancies and acquire additional information is required. Examining contracts, agreements, and purchase orders can help clarify the conditions that have been agreed upon.

Examine any supporting documents, such as shipment or delivery receipts, to ensure the transaction’s accuracy. By having the proper investigation, you can easily pinpoint the reason for the inconsistencies, miscommunication, or underlying errors and take essential steps to correct them.

5: Resolve Outstanding Balances

Once the primary causes of discrepancies have been identified, it is imperative to work with the vendor to settle any outstanding balances. This may necessitate adjusting payments to reflect the appropriate quantities or requesting credit notes for overpayments. As necessary, negotiate settlements or arrange for additional compensation in cases of underpayment.

Effective communication is vital to ensure that both parties resolve their issues. By collaboratively addressing outstanding balances and discrepancies, the vendor reconciliation process can be completed successfully, fostering a healthy vendor relationship and accurate financial records.

6: Document And Track

Throughout the vendor reconciliation format, it is vital to maintain complete documentation. It is essential to document all reconciliation activities, including correspondence with the vendor, such as e-mails and phone calls, and any invoice or payment adjustments along with opening balance in the vendor Account.

Document all reconciliation-related agreements and settlements. Keeping track of progress and automated reconciliation status also ensures that all stages are carried out correctly and facilitates future audits or inquiries. In the reconciliation process, well-organised documentation provides a clear audit trace of actions taken and facilitates transparency and accountability.

7: Communicate With Internal Stakeholders

Sharing the results of the vendor reconciliation format with internal partners is essential for transparency and making decisions that are based on accurate information. Share the results with the finance teams, buying departments, and management, and call out any problems or discrepancies that still need to be fixed.

Give updates on what has been done to fix these problems, such as adjustments made, agreements made with vendors, or outstanding amounts still being worked on. This information gives partners a clear picture of the financial situation, helps them make accurate reports, and makes it easier for them to work together to solve any problems that still need to be fixed in the vendor reconciliation process.

8: Monitor And Improve

Monitoring the vendor reconciliation procedure is essential for maintaining accuracy and efficiency. Review and evaluate reconciliation policies regularly to ensure they adhere to best practices and regulatory requirements. Streamline processes by identifying bottlenecks and development opportunities. Consider leveraging technology or automation tools, such as reconciliation software or electronic invoicing systems.

Monitor key performance indicators (KPIs) to monitor the efficiency of the process and make adjustments as required. By perpetually monitoring and enhancing the operation of vendor reconciliation, organisations can achieve greater efficiency, reduce errors, and improve their financial management as a whole.

Benefits Of Using the Vendor Reconciliation Format

Here are the following benefits of using the vendor reconciliation format:

1: Provides Accuracy

Vendor reconciliation formats are necessary for comparing and reconciling vendor statements with internal records. Businesses can significantly reduce the risk of errors and discrepancies by using a standardised format. This guarantees that financial data is accurately aligned, boosting integrity and dependability in vendor transactions.

The systematic approach of reconciling formats streamlines the process, making identifying and resolving any differences easier. Finally, this accuracy assists organisations in maintaining solid financial control and developing trusting relationships with vendors.

2: Provides The Efficiency

The provision of a vendor reconciliation format can significantly improve efficiency and assists organisations in matching the line items on the vendor statement with the invoices. With a standardised format, the reconciliation procedure becomes simpler and faster. It eliminates the need for manual adjustments or modifications, thereby saving time and effort.

Using a standard format, both parties can compare and reconcile their statements more efficiently, resulting in a quicker resolution of any discrepancies. This time-saving benefit permits businesses and vendors to concentrate on other essential duties and operations.

3: Helps With Dispute Resolution

Using a vendor reconciliation format makes it easier to find and fix differences with sellers, making resolving disagreements smooth and quick. Using a standard format, companies can easily find out where the difference came from and let the vendor know what’s happening.

This streamlined vendor statement encourages quick resolution and makes it less likely that misunderstandings or conflicts will last long. The reconciliation format is a point of reference that lets both parties match up their records and work together to find a solution. It is essential for having good vendor relationships.

4: Cash Flow Management

Accurate vendor reconciliations are key to how well a business manages its cash flow. By reconciling vendor statements correctly, businesses can see what payments are still due in real-time, giving them a clear picture of their financial responsibilities.

It allows businesses to set priorities and plan their payment schedules, ensuring payments are processed on time and avoiding fines for late payments. By using correct vendor reconciliations to manage cash flow well, businesses can keep their finances in good shape. You can easily manage your cash flow more efficiently using online software, which helps you with supplies, inventory, or services.

5: Better Financial Control

Using a vendor reconciliation format improves financial control by giving a structured way to keep track of bills, payments, deal opening balance, closing balance and account balance to vendors. This format helps businesses make sure that all transactions are properly recorded. This lowers the risk of payments being made without permission or in error.

By comparing vendor statements with their records, companies can find and fix any mistakes quickly, keeping their financial data accurate. It improves control, protects against fraud, makes it easier to follow financial rules, and builds trust in the truth and reliability of financial records. In the end, it supports good financial management practices.

6: Check The Audit Balance

A uniform vendor reconciliation format considerably simplifies audit preparations by providing a thorough record of vendor transactions. This format guarantees that all critical information is written systematically, making financial data verification and validation easy during the audit process.

Auditors can quickly evaluate the reconciliation data and compare them to vendor statements and internal records to find any anomalies or irregularities. The standardised format streamlines the audit trail, saving time and effort for the auditors and the company being audited while ensuring financial reporting compliance and transparency.

7: Cost Savings

Businesses can save money by implementing a vendor reconciliation format. Automating the repetitive task eliminates the time-consuming manual reconciliation and saves labour expenses. Timely and precise reconciliation also helps avoid late payment penalties, protecting financial resources.

Furthermore, the risk of overpaying vendors is reduced, avoiding wasteful spending. These cost-cutting benefits increase financial efficiency, allowing organisations to deploy resources better and increase overall profitability. Implementing a vendor reconciliation format is beneficial for the long-term financial stability and investment of companies.

8: Better Data Analysis

A vendor reconciliation format is a valuable data source for analysis, allowing businesses to spot trends, evaluate vendor performance, negotiate good terms, and improve buying processes. By looking at the data, businesses can find patterns, make choices based on the data, and improve their buying strategies.

They can find the best vendors, arrange better prices, and improve supplier management. Also, the insights gained from the analysis help to optimise inventory levels, reduce costs, and streamline procurement processes. This leads to better efficiency, financial results, and market competitiveness.

Features in Vyapar App That Makes It Best For Reconciliation Process

Record Your Business Expenses:

Tracking and recording all incurring expenses is essential for reconciliation and tax filing. Using the Vyapar billing software, monitoring expenditures and generating an accurate report for your small business is simpler. Vyapar automates repetitive tasks inside your business, saving your business time and money.

Our free billing application is an efficient way to track expenses and optimise businesses with your company’s expenditures to save more money with relative ease. Using our free billing software, you can effortlessly record GST and non-GST expenses. It allows you to reduce operational expenses and increase sales using essential tools and features.

Our PCs application is ideal for expanding enterprises. It helps keep their finances in check. By recording expenses using GST accounting software, the business is able to optimise expenditures. Keeping track of business expenditures will also aid in the development of superior strategies. It will result in increased business profitability.

Provides 7 days Free Trial:

Vyapar’s billing software for small businesses allows everyone to use our premium app free for 7 days before deciding to buy them. You can thoroughly review its features and functions and see if it matches your business expectations. During these 7 days, you don’t have to pay monthly fees for using our premium tool. Vyapar charges no application fees from businesses operating their function from Android devices.

You can do a lot of tasks in Vyapar, from billing, invoicing, report making, receivable and Payable and money. Other features help you in the vendor reconciliation process, which makes vendor accounts more efficient and helps to save a significant amount of money. Over One crore small companies use Vyapar because it is highly efficient and easy for their users.

If you want to use Vyapar window software for small and medium business computers, you must pay a small subscription fee after 7 days. After the end of the trial period, you can go for a full-time subscription to our best online accounting software. It is value-for-money accounting software and saves these businesses a lot of time and effort.

Billing And Invoicing Software:

Our free GST billing software that does everything is a great addition to your business because it helps you handle your billing and invoicing needs seamlessly. It works well to help small and medium-sized businesses save more time and effort on budgeting and reconciliation.

With the help of Vyapar billing software with GST, business owners could do things like file GST returns, check opening balances in vendor accounts and handle their inventory or services received, send out invoices, and send out bills. Businesses can change the areas in our free accounting app as per their preference to meet their own needs.

You can use the Vyapar app to quickly create GST bills, invoices, and vendor reconciliation statements for your clients, which you can print or send through E-mail, WhatsApp or text messages to your business clients. Most bills and invoices should be in the GST invoice format, and you can easily create them with our GST billing and accounting software.

Manage Your Inventory Space Effortlessly:

With our premium inventory management software, you can keep track of the goods in your store that are still available. It can help you set up alerts for low stock or understocking so you can place orders ahead of time and find signs of possible theft. It can help you to analyse the trends based on previous sales data and reports.

Inventory management is important for small and medium-sized businesses that sell many different products, and our free inventory tools can help. Our program lets you track what’s in your store and from anywhere across India. You can easily access the real-time inventory data on the Vyapar business dashboard.

Our billing software features can help you determine if any item is misplaced or lost. As you sell items, the number of items in stock goes down. Using the inventory software, you can check regularly to determine if your inventory doesn’t match up. You can check your security cams as soon as you notice something is missing.

Filing GST Is Made Simpler And Quicker:

Filing GST is a challenge for small business owners; if done manually, it can be very time-consuming and prone to human errors. Using Vyapar software, you can create GST reports for your reconciliation process and make the GST filing process seamless.

Many business owners spend their time and effort every month to file GST reports. Vyapar ensures that businesses comply with the tax laws and regulations of the Government Of India. After all, they must keep track of their monthly bills, invoices, expenses, and accounting details.

Vyapar changes it all, helping to create dedicated GSTR reports and saving time by repeating the automated task in your business. Vyapar can help you create reports from the app with multiple GSTR reports like GSTR1, GSTR2, GSTR3, GSTR4, and GSTR9. It is beneficial as it eliminates the need to hire an extra employee to care for your business accounting.

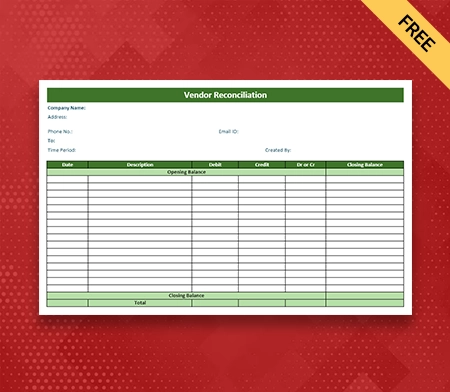

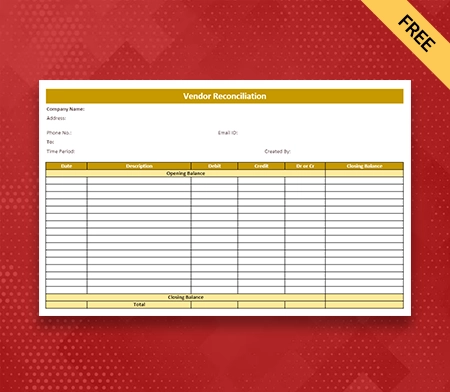

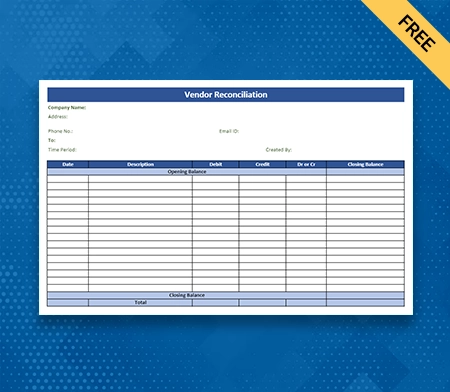

Create Your Reconciliation Format With Different Themes:

Keeping a professional reconciliation format and sending it to your stakeholders, board members, and clients can improve your brand’s identity. The Vyapar app offers two styles of thermal printers that you can use for bills. You don’t need to find the details for your reconciliation format separately, as it already comes with the essential information required for your format.

This program makes it easy to make your vendor reconciliation format look better. It’s easy to use the customisation options offered to enhance the look of your format, improving the customer experience and helping you with increased customer trust in your business. It also has 12 invoice and reconciliation templates for standard printers.

The Vyapar app is a good way to get the best vendor reconciliation format standard quickly and easily. It allows you to choose from a variety of themes for both thermal and normal printers. Vyapar Software is best compared to other software’s and you can change all styles to fit per the needs of your business.

Frequently Asked Questions (FAQs’)

A vendor reconciliation format is a standardised template or framework to organise and report vendor account and transaction information. It assists organisations in comparing their records to those of their vendors to discover and resolve inconsistencies and ensure accurate financial reporting and payment administration.

The vendor reconciliation format is critical for businesses because it maintains the accuracy of financial records while also strengthening vendor relationships. It assists in identifying any differences between the company’s and vendor’s records, allowing for prompt error rectification and the prevention of financial losses.

Effective vendor reconciliation fosters transparency, improves cash flow management, and ensures timely payments, contributing to more efficient corporate operations and vendor satisfaction.

A vendor reconciliation format usually includes key information like the vendor’s name, invoice or transaction details, payment information, dates, amounts, outstanding balances, and any errors found during the reconciliation process. It could also have additional comments or notes about certain transactions or problems.

You can find many standard templates or formats available online, but you may need to include essential information or customize them per your business requirements. You can use our premium software to create and customise your professional vendor reconciliation in different templates and formats.

The frequency of vendor reconciliation is contingent upon the business’s size, number of vendors, and volume of transactions. Experts generally advise executing vendor reconciliation regularly, such as monthly, quarterly, or annually, to ensure timely identification and resolution of discrepancies. To maintain accurate records, high-volume enterprises may require more frequent reconciliations.

By comparing the company’s records with the seller’s, vendor reconciliation helps find mistakes and find ways to fix them. It means comparing invoices, payments, and other transaction information to find differences or discrepancies. By comparing these records, companies can find mistakes, fix discrepancies, and make sure financial reports are correct. This leads to better financial accuracy and better management of vendor relationships.

You can easily automate your vendor reconciliation format using our Vyapar tool. Your business can easily remove the repetitive task and save time and effort, which you can then devote to essential areas of your business platform. Vyapar is free for Android users and charges no fees to use our tools and features.

While preparing a vendor reconciliation format, it’s essential to get accurate information, match up transactions and balances, keep clear records, talk to suppliers well, and do regular reviews to find and fix problems. You can also use Vyapar software to get real-time updates on the Vyapar business dashboard.

Vendor reconciliation improves financial accuracy and ensures timely payments by comparing a company’s records with the vendor’s. It helps identify discrepancies, such as pricing errors or missing invoices, prevent overpayments or delayed payments, maintain accurate financial statements, build trust with vendors, and avoid penalties or strained relationships due to late or incorrect payments.

To perform vendor reconciliation:

1. Collect invoices and payment records.

2. Match invoices with payments.

3. Resolve any discrepancies with the vendor.

4. Update accounting records.

5. Reconcile accounts to ensure accuracy.

6. Document the process for record-keeping.

Vendor reconciliation duties include:

1. Matching invoices accurately.

2. Verifying payments made.

3. Identifying and resolving discrepancies.

4. Maintaining detailed records.

5. Updating accounting entries.

6. Ensuring account balances align with vendors’ records.

To reconcile a vendor:

1. Collect invoices and payments.

2. Match invoices and verify payments.

3. Resolve any discrepancies.

4. Update accounting records.

5. Reconcile accounts for accuracy.

Related Posts: