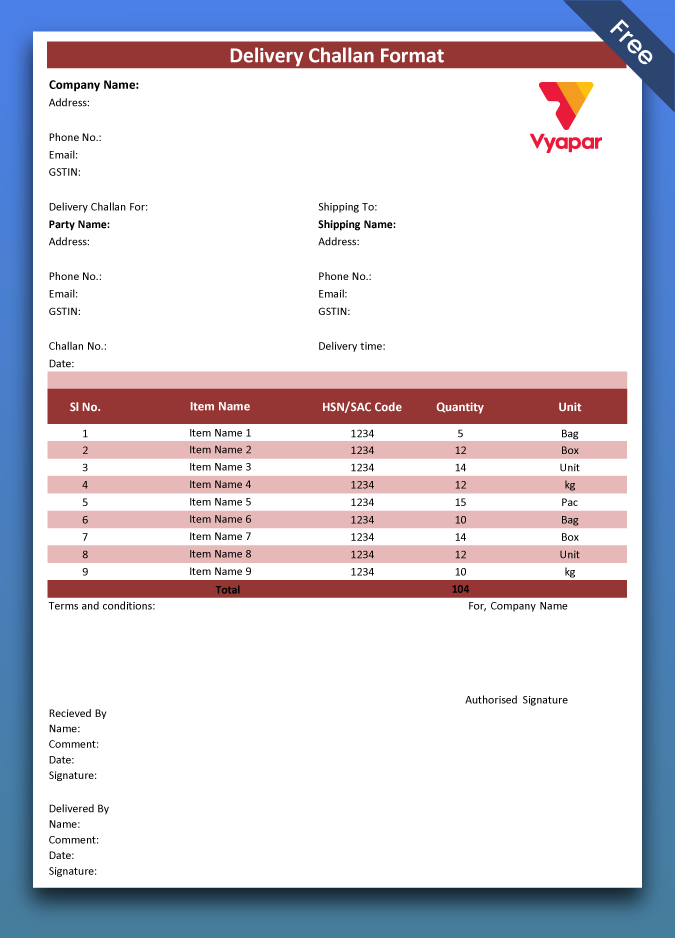

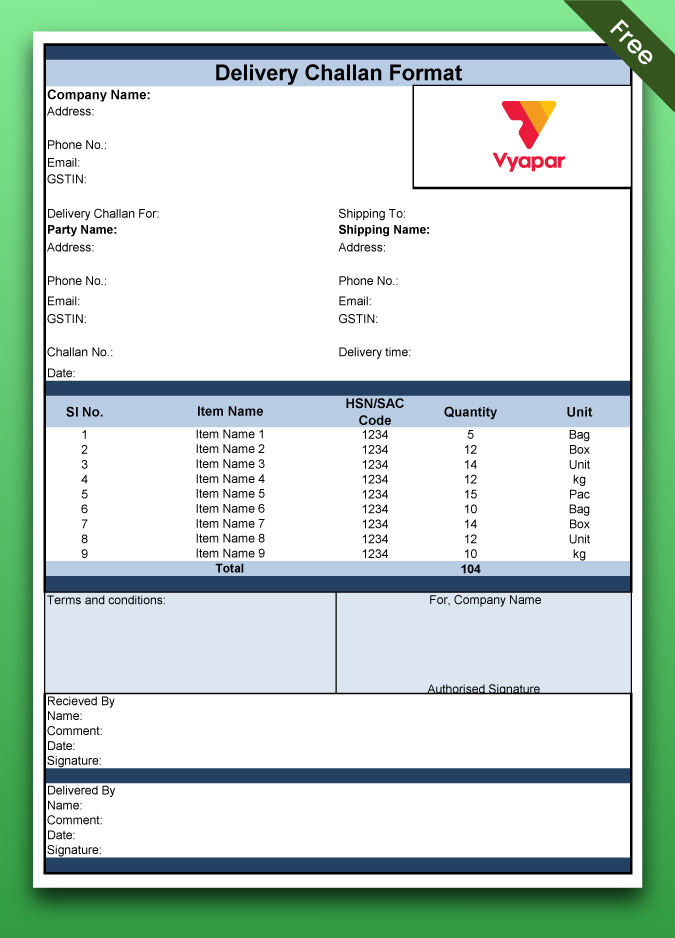

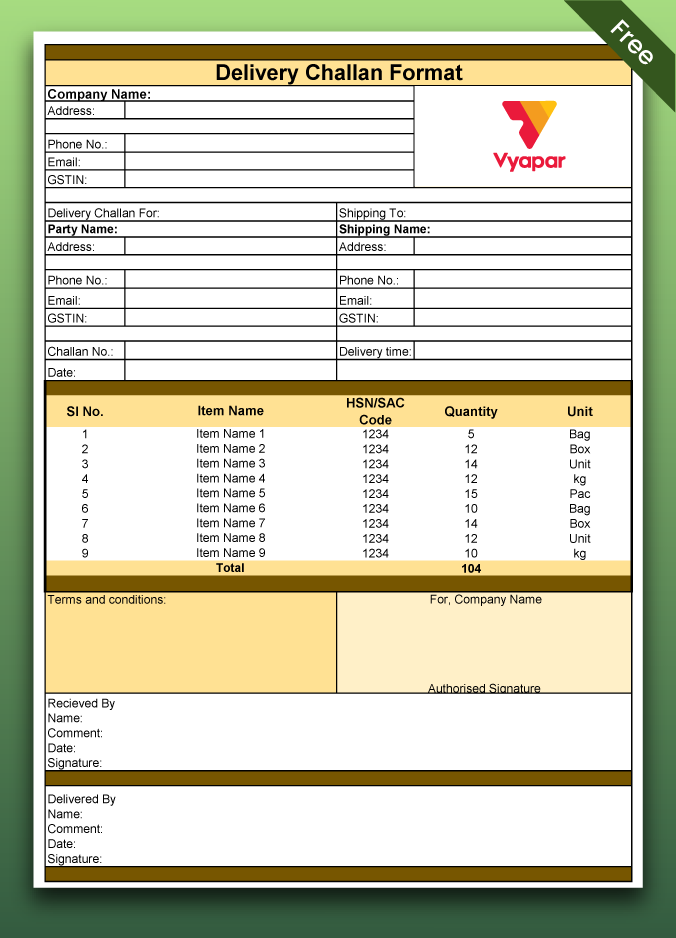

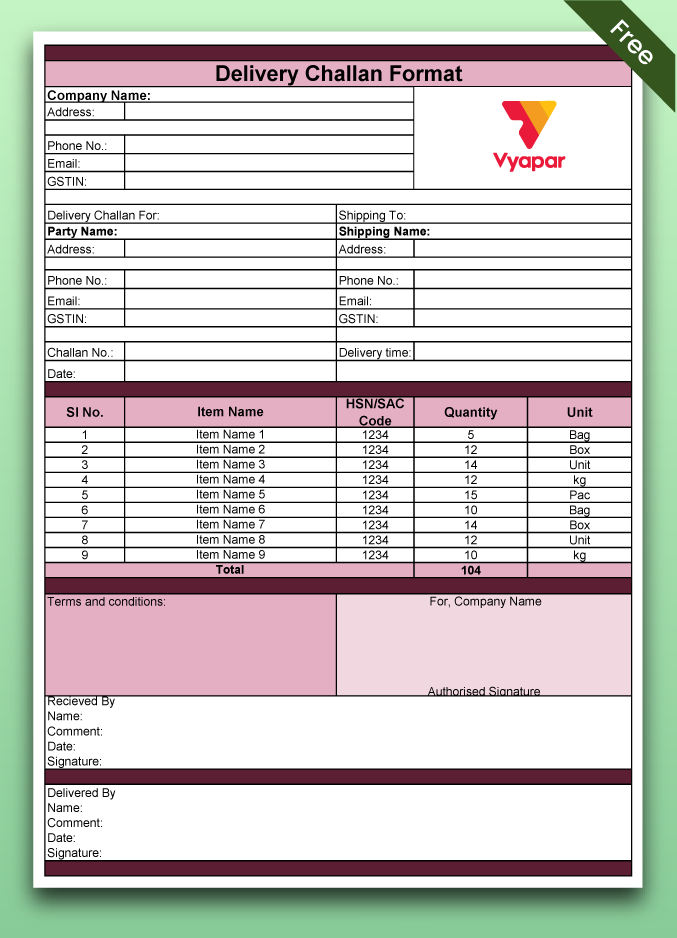

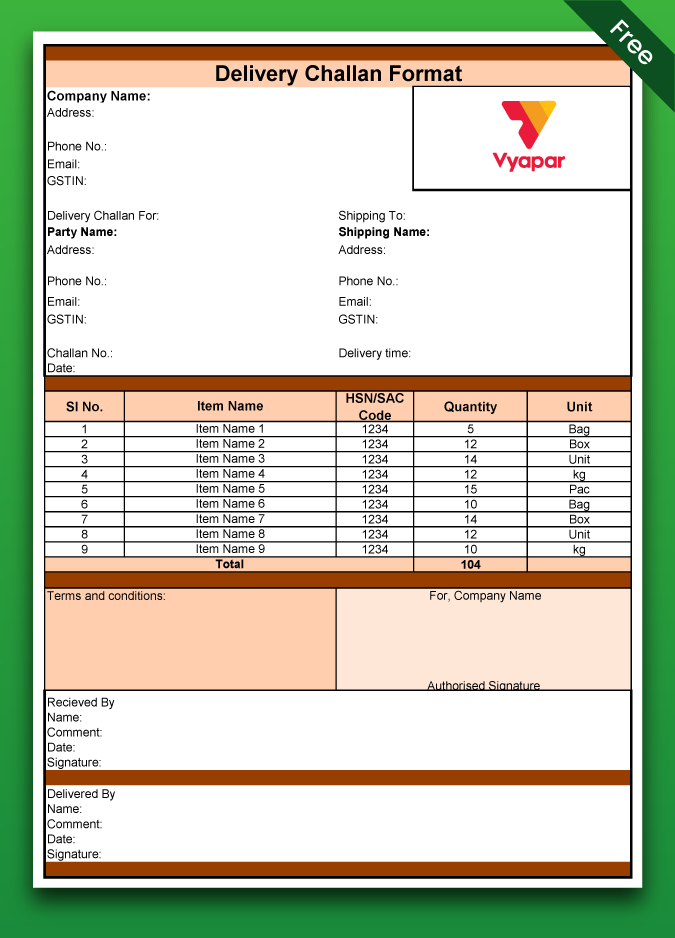

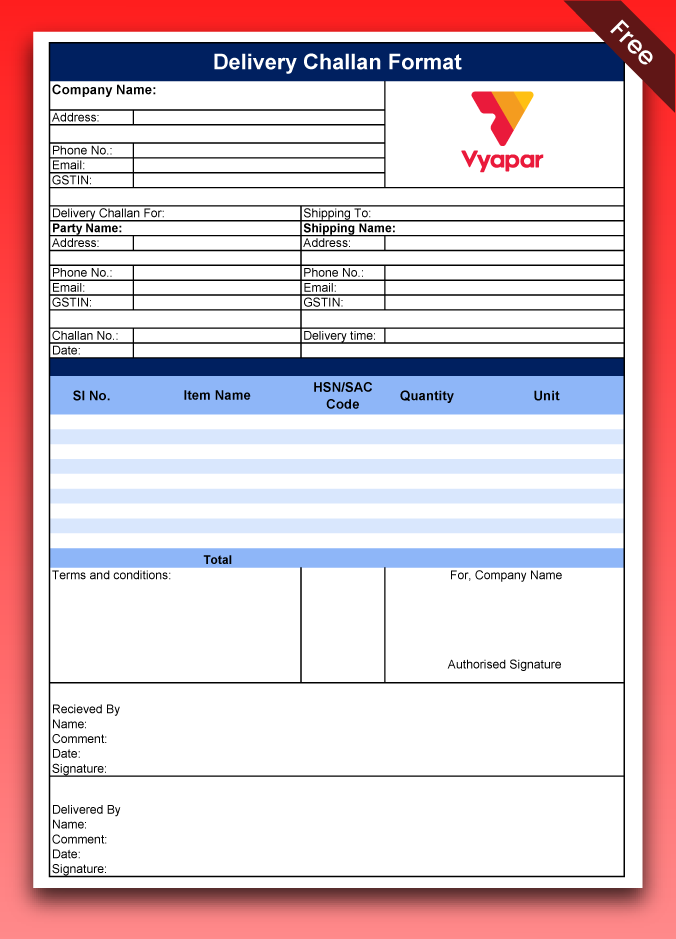

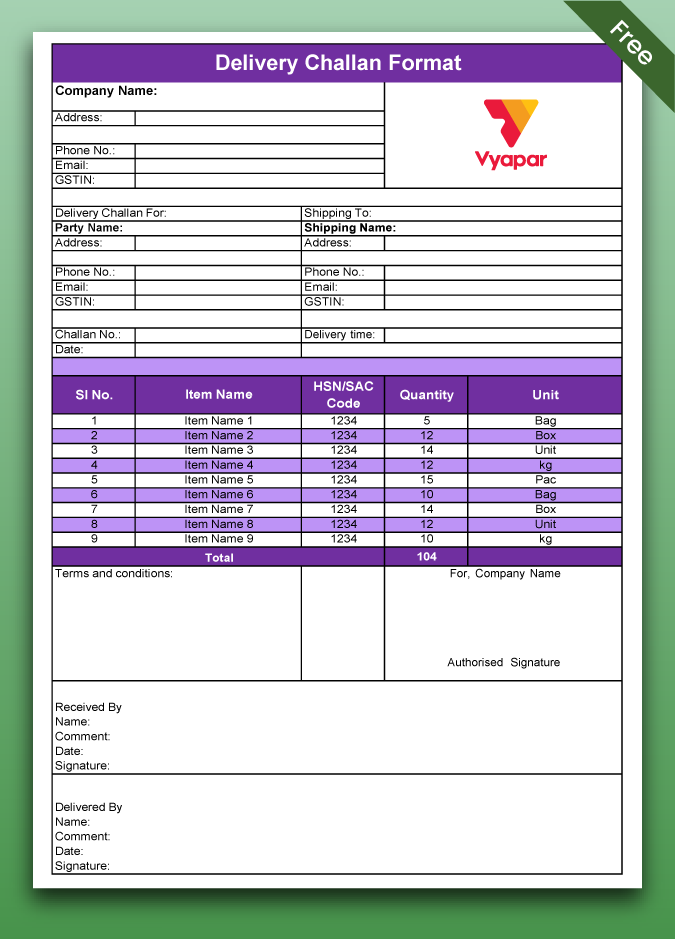

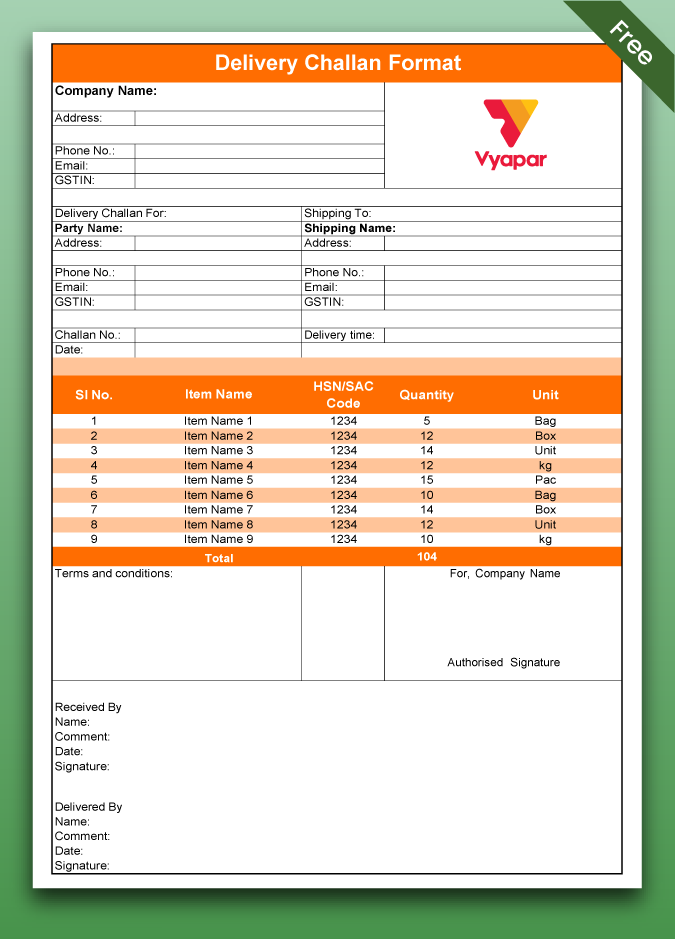

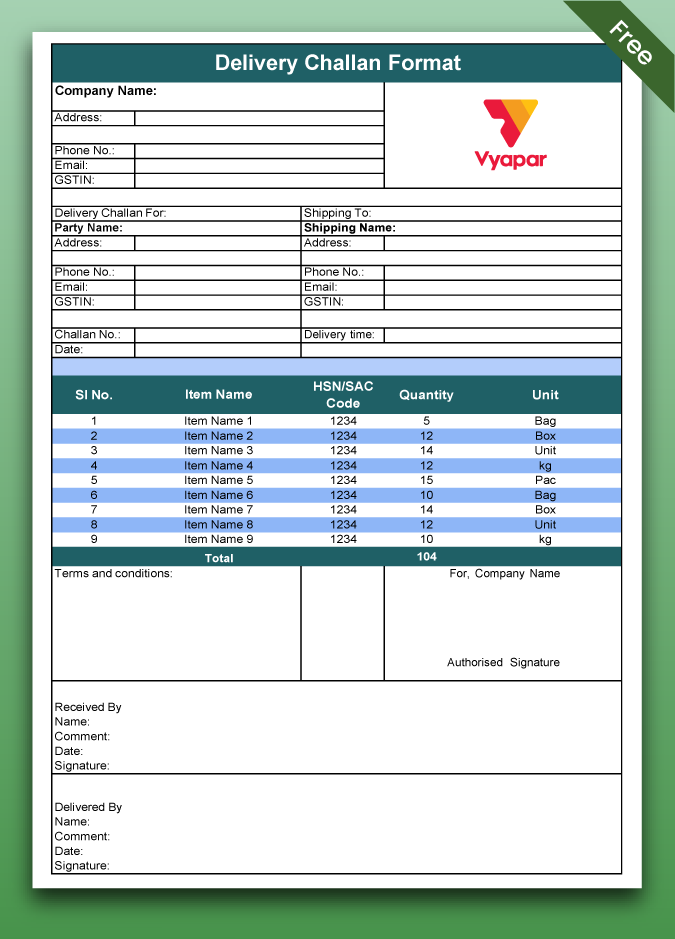

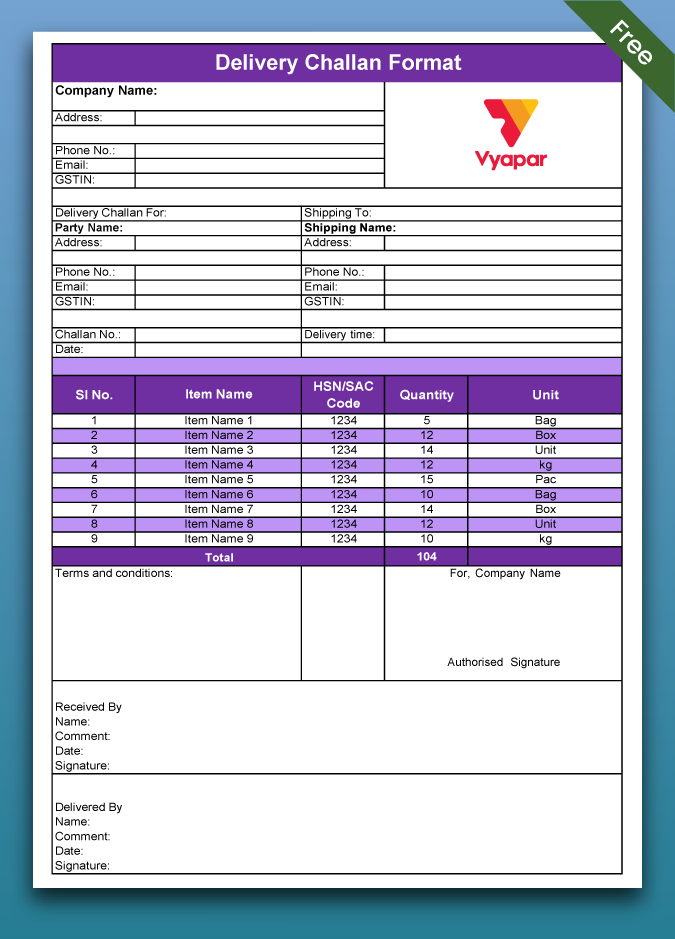

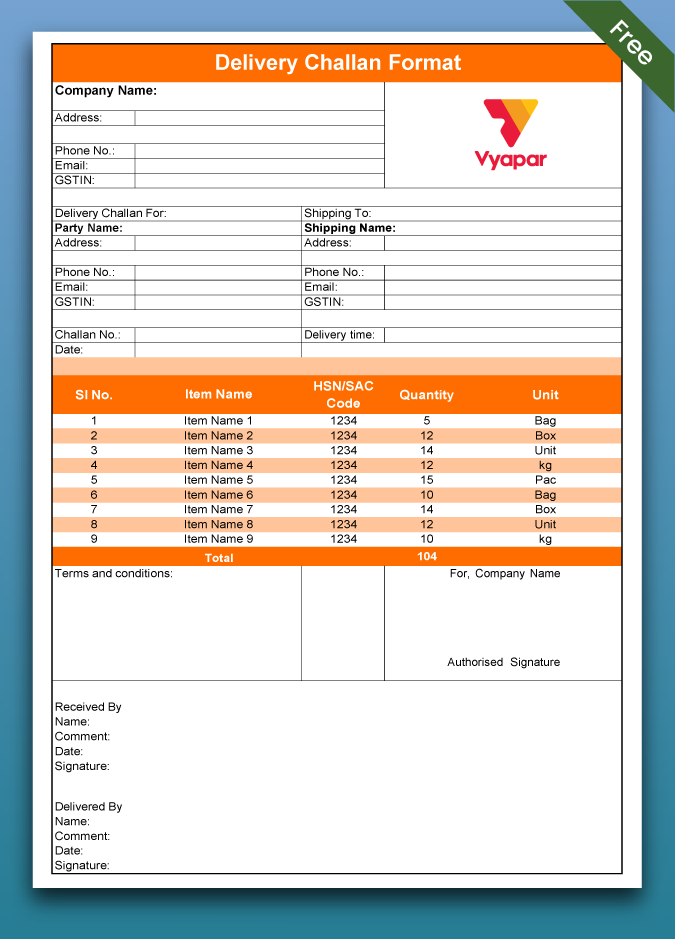

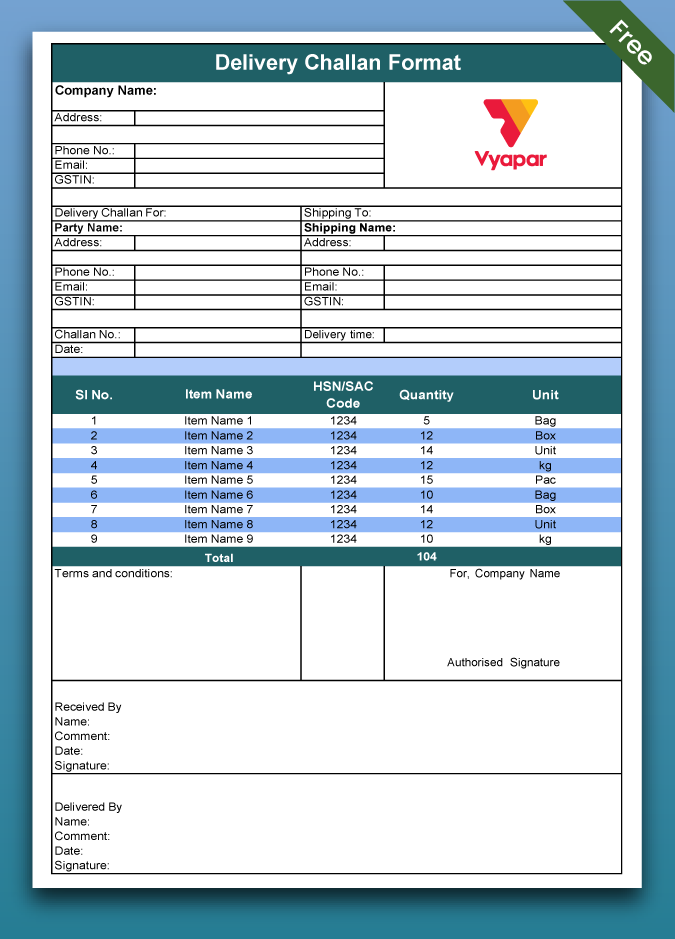

Delivery Challan Format in Word, Excel, PDF

Download a free, customizable GST Delivery Challan format in Word, Excel, and PDF. Includes name, address, date, items, and GSTIN for accurate deliveries. Alternatively, use the Vyapar app to make delivery challans with premium features.

- ⚡️ Vyapar offers over 50+ templates to create challans

- ⚡ Easily convert to sales with Vyapar

- ⚡️ Accepts payments with UPI

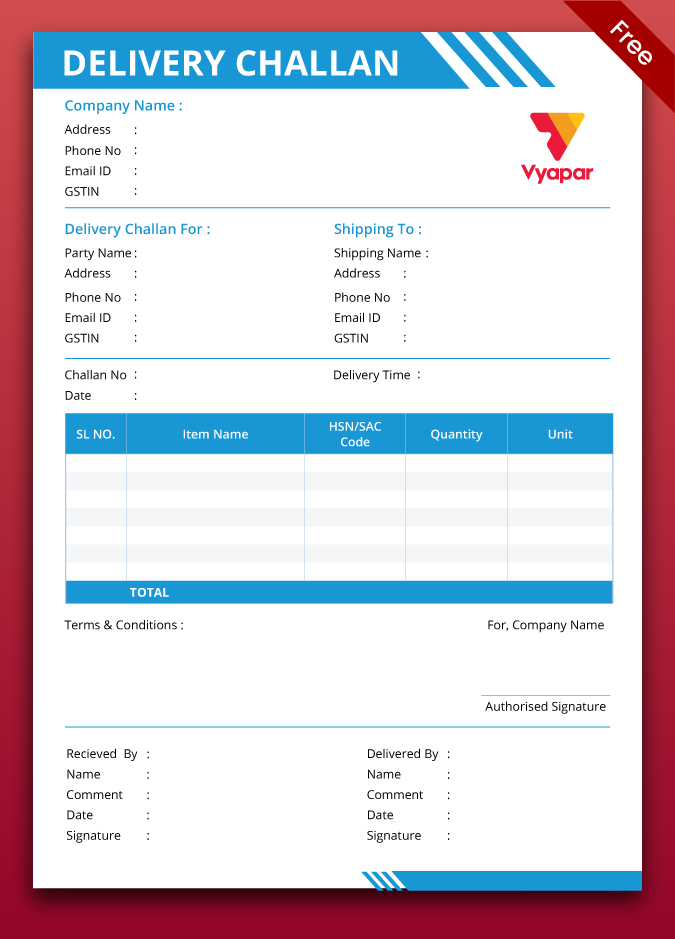

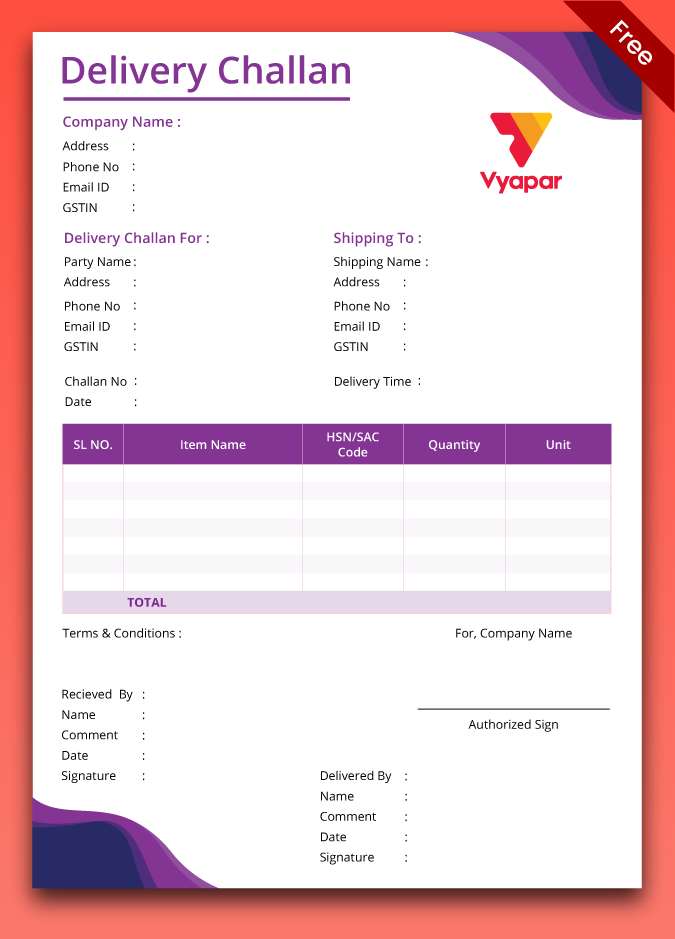

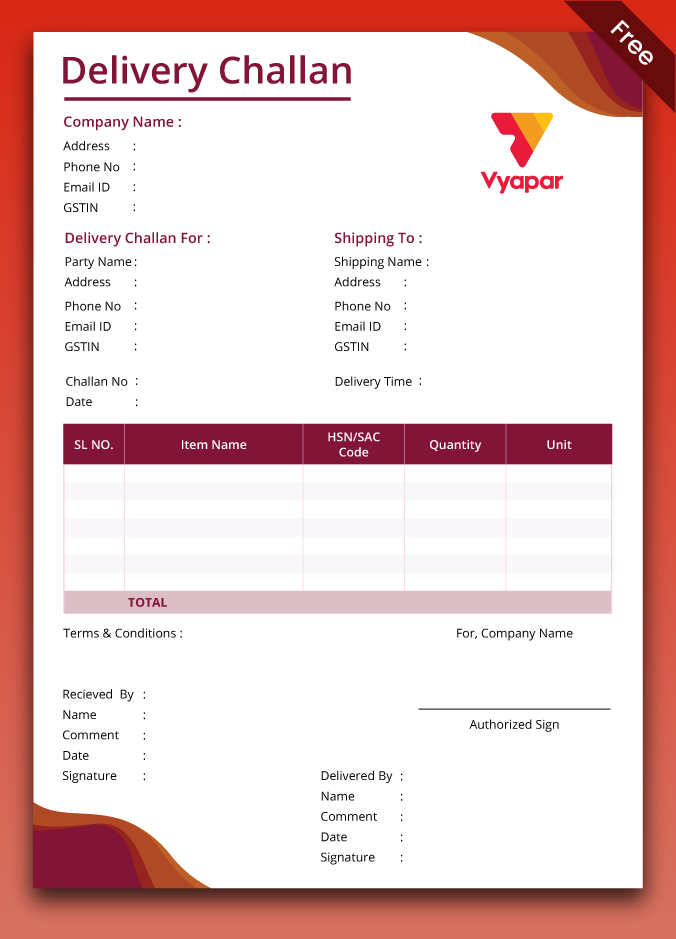

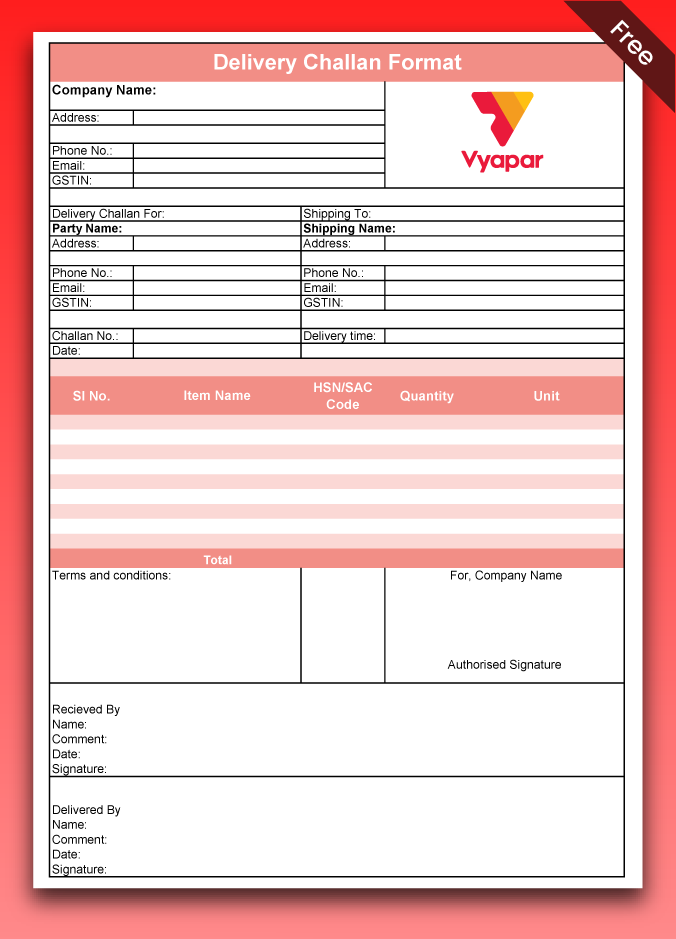

Download Free Delivery Challan Format in Word, Excel, PDF

Explore delivery challan templates, and make customization according to your requirements at zero cost.

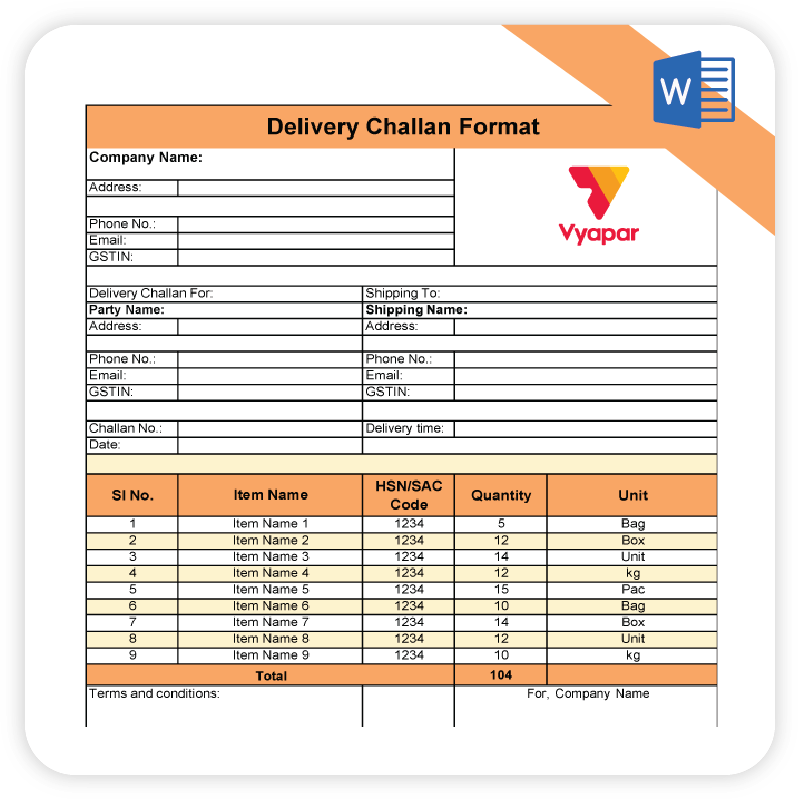

Word Delivery Challan Format

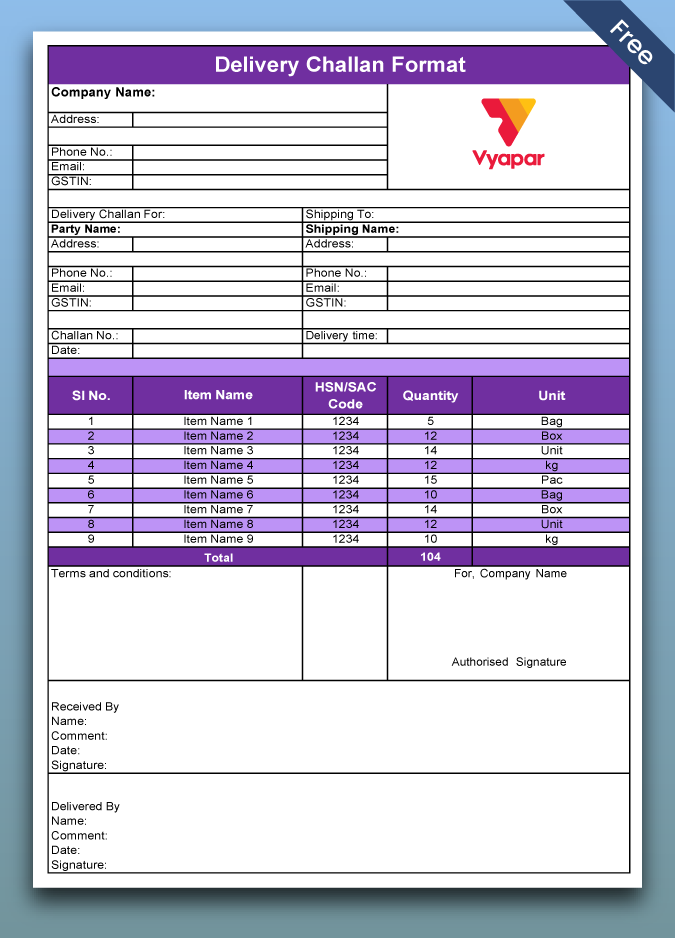

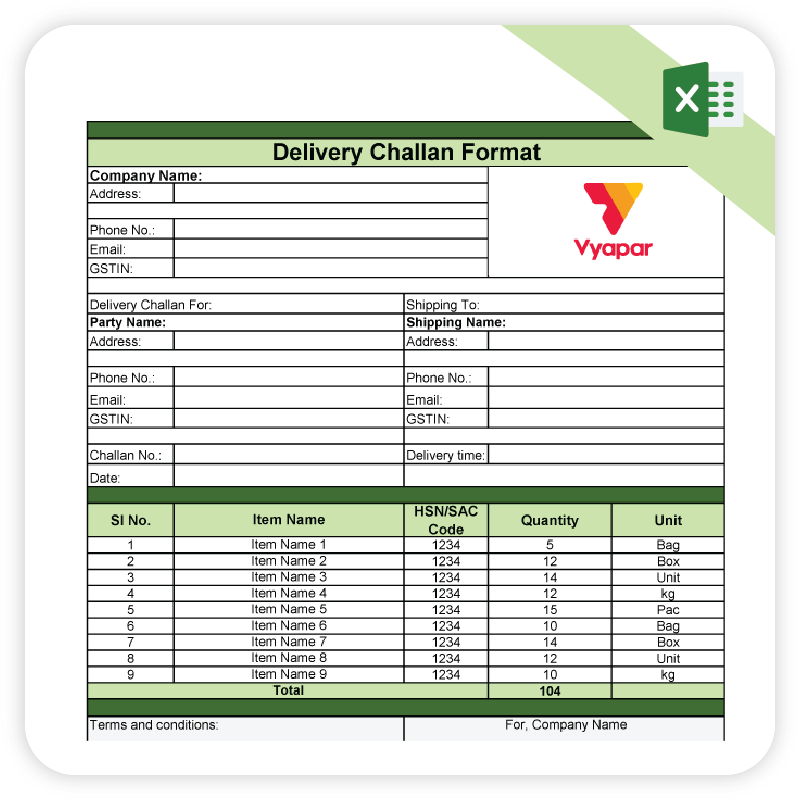

Excel Delivery Challan Format

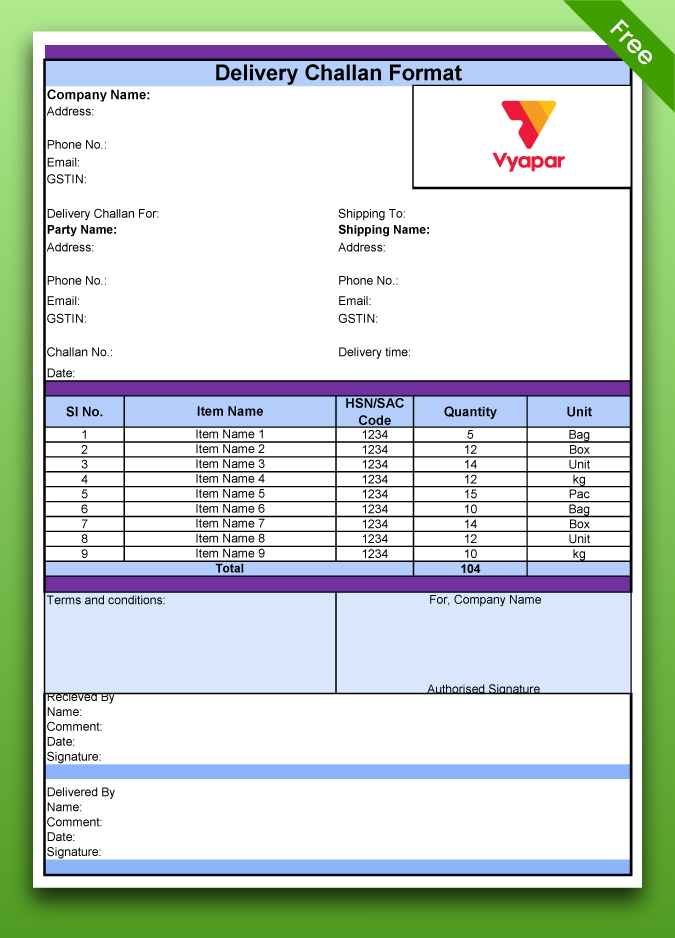

PDF Delivery Challan Format

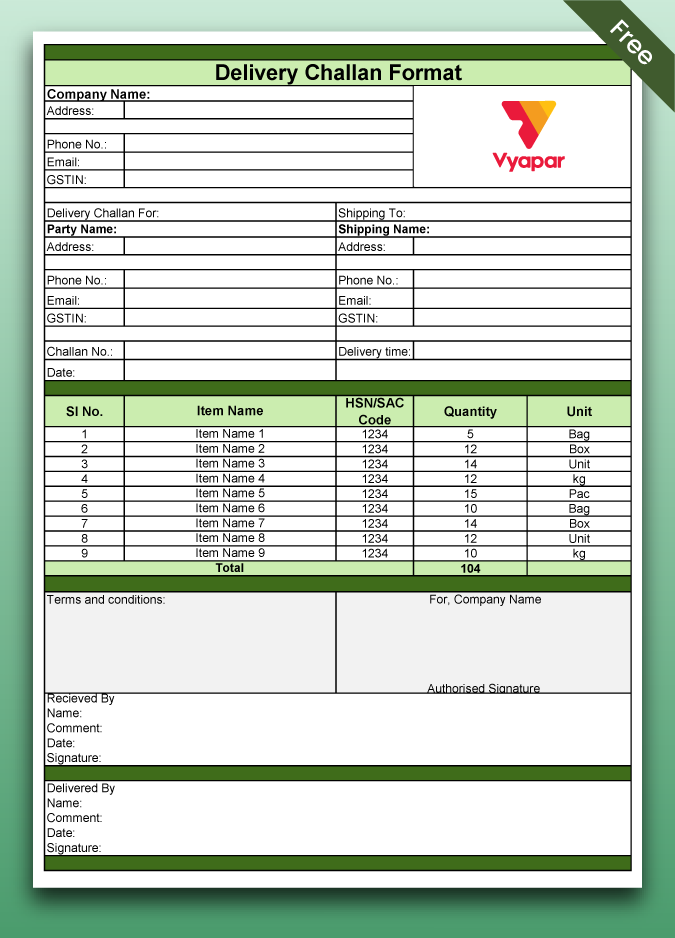

Delivery Challan in Google Sheets

Delivery Challan in Google Docs

Challan Formats

Create Your First Delivery Challan with Vyapar App

What is Delivery Challan?

A delivery challan is a document used in business transactions to acknowledge the delivery of goods from the supplier to the receiver. It serves as proof that the items listed in the challan have been physically delivered to the buyer or recipient.

Example:

Suppose a stationery supplier delivers boxes of notebooks to a local bookstore. The supplier prepares a delivery challan listing the number of boxes, type of notebooks, and delivery date. The bookstore receives the goods, verifies them against the challan, and signs it to confirm receipt. This signed challan serves as proof that the goods were delivered, but no payment details are mentioned.

In essence, the delivery challan helps both the supplier and the receiver maintain accurate records of goods transferred, ensuring transparency and smooth operations.

In Which Circumstances Delivery Challan is Required

Goods Sent with Approval

It would be best if you issued the delivery challan at the time of removal of goods from the state or outside of the state with approval for sale or return and before supplying them.

Transporting Artwork to Various Galleries

Artists carry their artworks to various galleries, where these are exhibited and sold from such galleries if the buyer selects the work. An artist should transport the artworks from one gallery to another within or outside the state under a delivery challan.

Sending Products Outside of India for Display or Export Marketing

The removal of goods from India for exhibition or on a consignment basis for export promotion is not considered either a “supply” or an “export,” according to CBI&C Circular No. 108/27/2019-GST, dated July 18, 2019. LUT or a bond is unnecessary because it is not an “export.” The seller must use a GST Delivery Challan format to send the goods.

Goods Transfer in Multiple Shipments

The supplier must issue the full invoice before dispatching the first shipment of goods when they are being transferred in multiple shipments. Also, they must issue a delivery challan for each additional shipment concerning the original copy of the invoice if the goods are being transported partially or entirely.

At the Time of Removal of Goods

The supplier may issue a delivery challan and transport the goods if the goods are intended for sale or supply, but the tax invoice cannot be issued under Rule 55(4) of the CGST and SGST Rules, 2017. The tax invoice will be issued after the goods are delivered.

When e-way Bills are not Necessary

You can transport the goods using this Challan if the e-way bill, tax invoice, or Bill of Supply is unnecessary, following Rule 55A of the CGST Rules, which took effect on January 23, 2018.

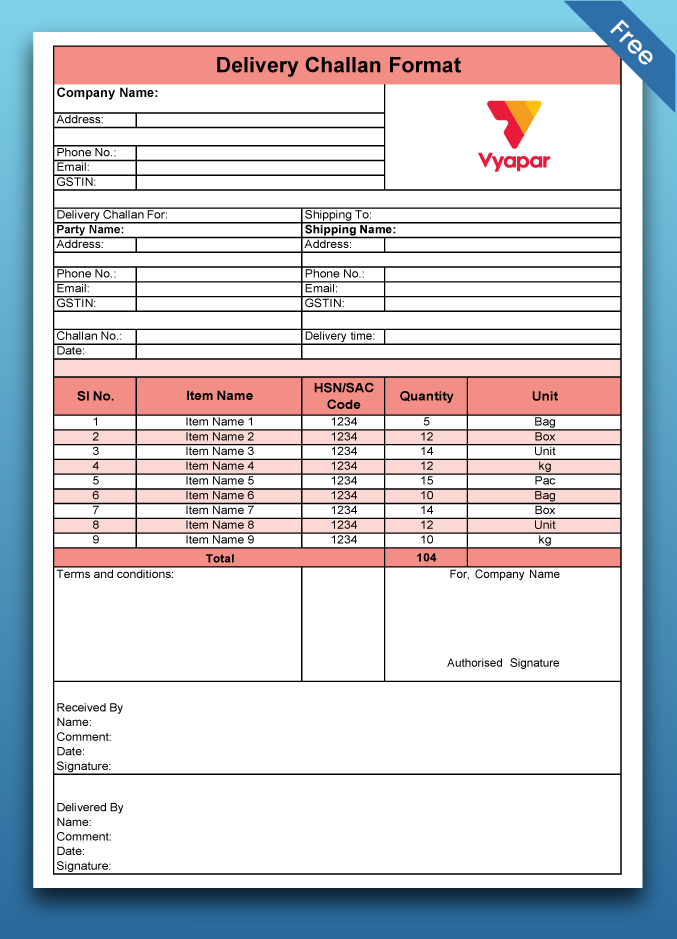

Key Components of GST Delivery Challan

Receiver’s Details

This section includes the name and contact information (like phone number) of the person or business receiving the goods for easy communication.

Details of Supplier

The supplier’s name and mobile number are listed to provide contact details for the receiver in case they have any questions or concerns.

Address and GSTIN or UIN

The supplier’s name and mobile number are listed to provide contact details for the receiver in case they have any questions or concerns.

Date and Number of Challan

The delivery challan has a unique number and the date it was created, helping both parties track and reference the document.

Description of the Goods

The goods section lists what is being delivered, describing each item clearly, including quantity and specifications to avoid confusion.

HSN Code of the Goods

This is a special code for each product that helps categorize them for tax purposes, making sure they are taxed correctly.

Total Quantity and Price

This part shows how much of each item is being delivered and its total price, so both parties can check if everything is correct.

Tax Rate

If taxes (like GST) apply to the goods, the applicable rate is listed to ensure proper tax calculation and compliance.

Place of Supply of Goods

This mentions the location where the goods are being delivered, which helps in determining the correct tax rate for the shipment.

Signature of the Supplier

The supplier’s signature confirms that the goods listed in the challan have been sent, serving as proof of delivery.

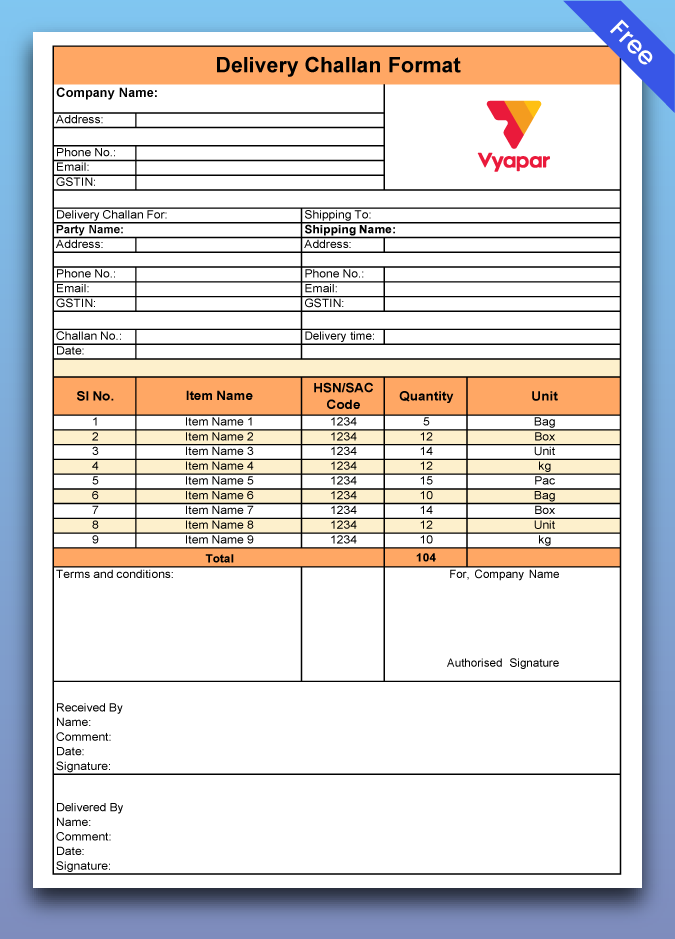

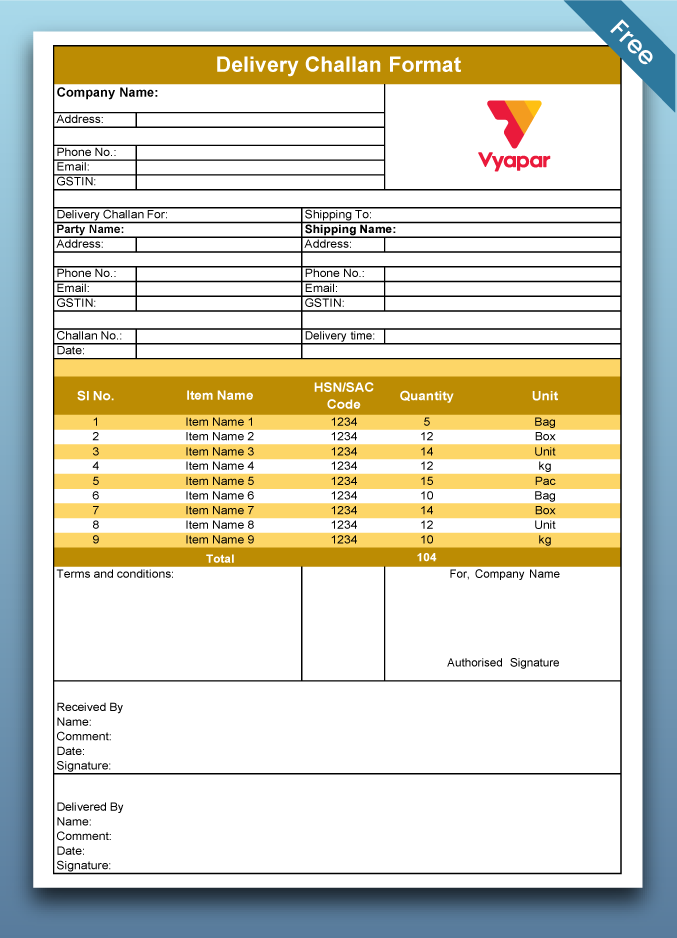

Easily Create Challan in Your Prefered Format

Delivery Challan Format in Word

As a result, using the template, you will make your own delivery challan format in Word.

- Find your favourite challan application format by browsing the available options.

- Make the necessary changes based on your shipment needs.

- Change the business name, goods description, client information, challan date and number, overall cost, and contact details.

- Change your Challan’s fonts, logos, and colours to suit your needs.

Keep the DC format in Word for reference in the future. Now it’s simple to create an invoice, download the challan copy, and submit it.

Delivery Challan Format in PDF

PDF format is convenient, and you can easily share it with your clients. You need to download the delivery challan format in PDF, make the necessary changes, and share it with the buyer and transporter.

You can still download delivery challan in PDF format that is in other forms, like Word and Excel. Here are the steps:

Step 1: On the menu bar, click on ‘File’

Step 2: Select the “Save” option

Step 3: Click on ‘Save As’

Step 4: Then, under ‘Save as Type,’ choose “PDF.”

Step 5: Lastly, click on ‘Save’

Delivery Challan Format in Excel

A “Delivery Challan Excel format” is something that many business owners search for because it makes the process easier to follow. And Vyapar allows you to choose multiple Excel templates for your challan.

Step 1: Download the challan application format

Step 2: Customize the details as per your business requirements

Step 3: Save the challan copy

Once you’ve created an Excel challan using Vyapar, you’re ready to send it to your customers. Here’s what you need to do:

Step 1: Open the .xls file on your device.

Step 2: Examine and validate the particulars of the invoice.

Step 3: Send the Excel invoice to your client by opening your email and attaching the Excel template

A delivery challan is a collection of data represented through tables, and Excel naturally works with data that includes tables. Due to Excel’s extensive library of formulas, calculations take less time to complete. The best feature of Excel DC format is that it gives a beautiful appearance, which is why trading businesses prefer it for internal use.

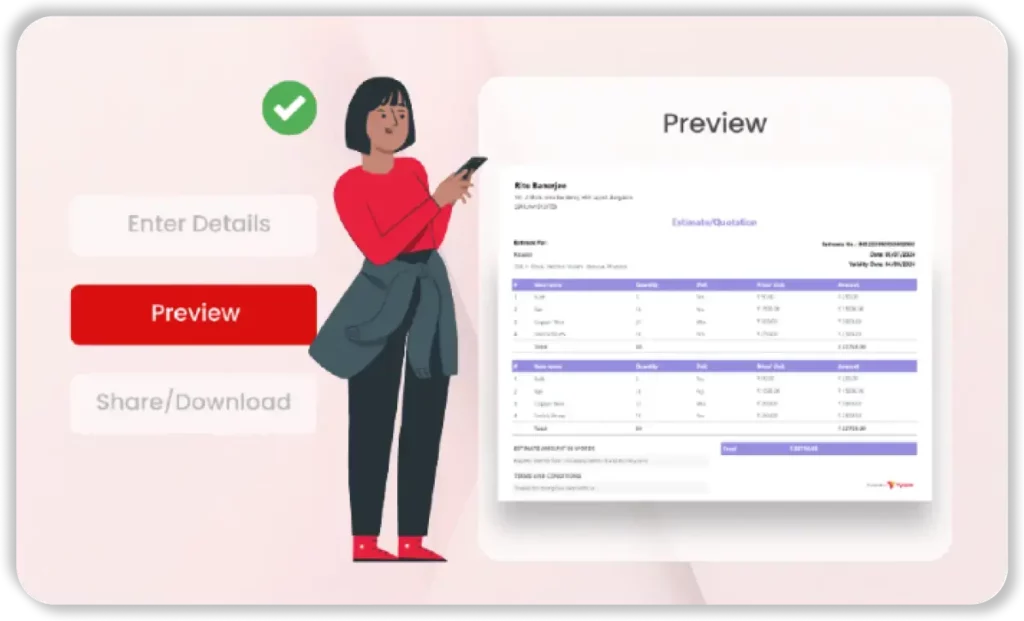

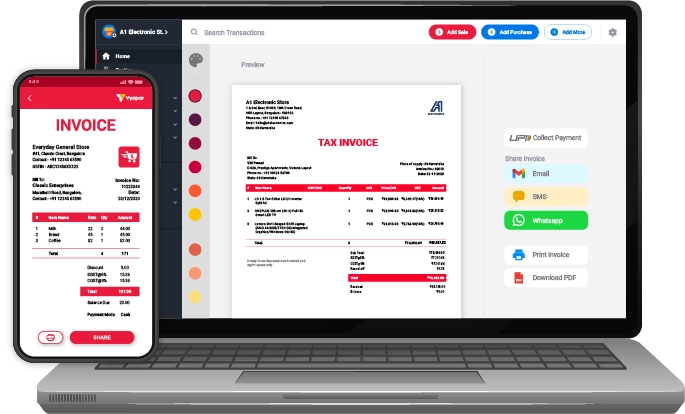

How Do You Create a Delivery Challan in Vyapar App?

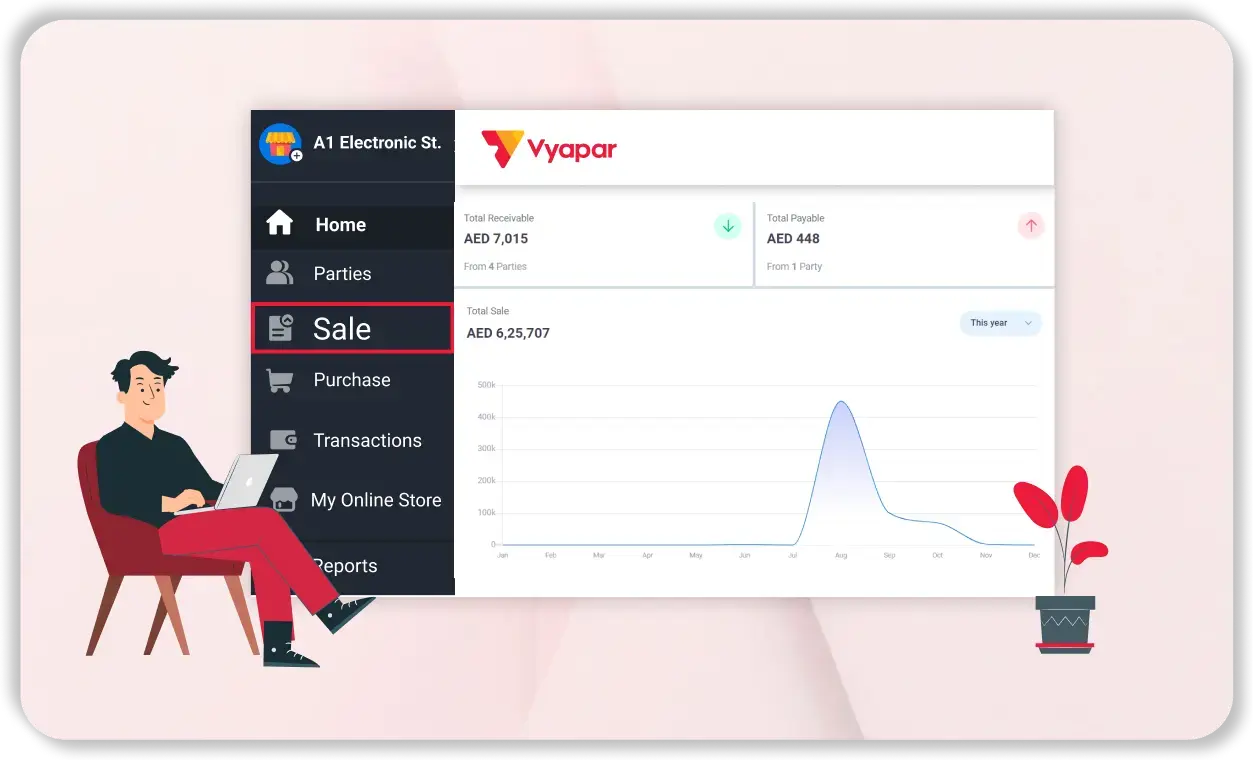

1. Open Vyapar App Dashboard

- Open the Vyapar app on your device. Access the main dashboard where you manage business transactions, and click on the “Sales” menu for more options.

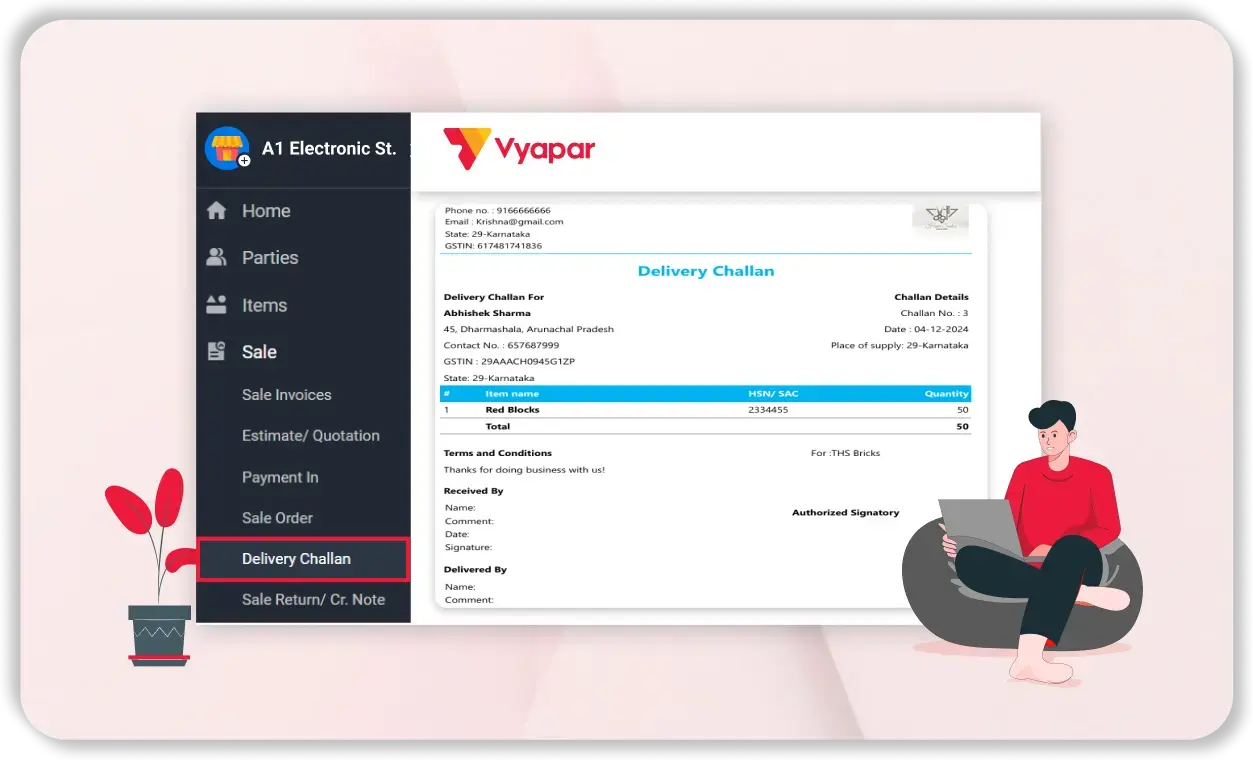

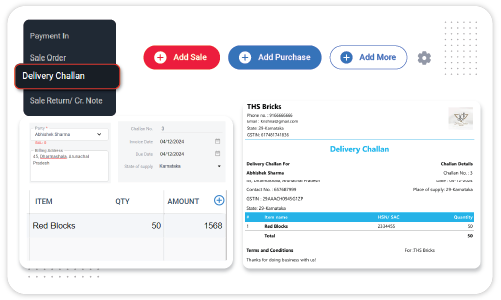

2. Choose Delivery Challan

- From the available transaction types in the “Transactions” menu, select “Delivery Challan” to start creating a document for transferring goods without billing them immediately.

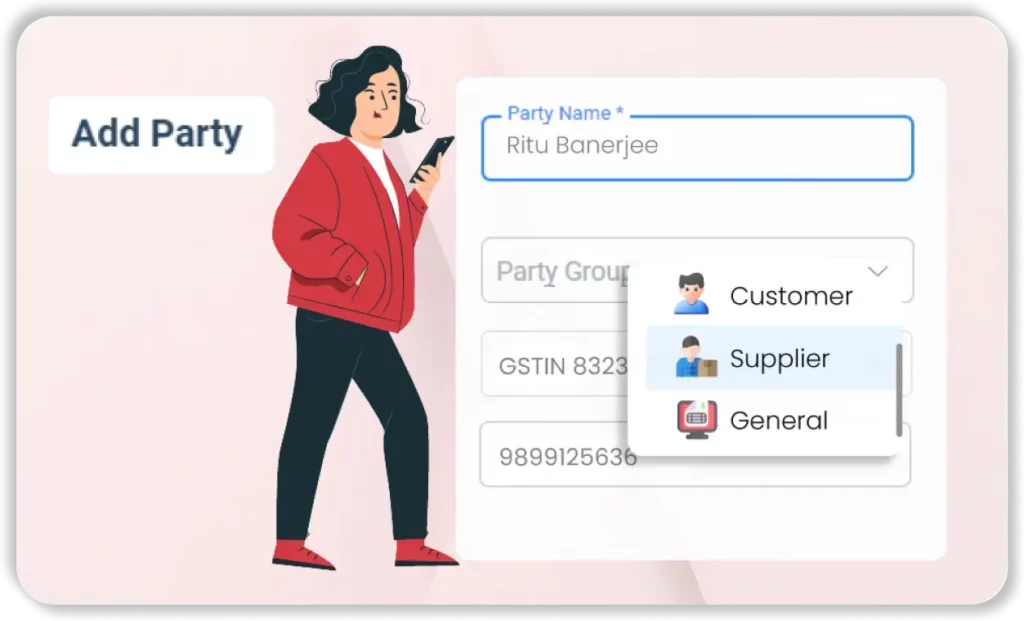

3. Enter Party Details

- Add the recipient’s details by selecting an existing party or creating a new one.

- Include the party’s GST information, if applicable.

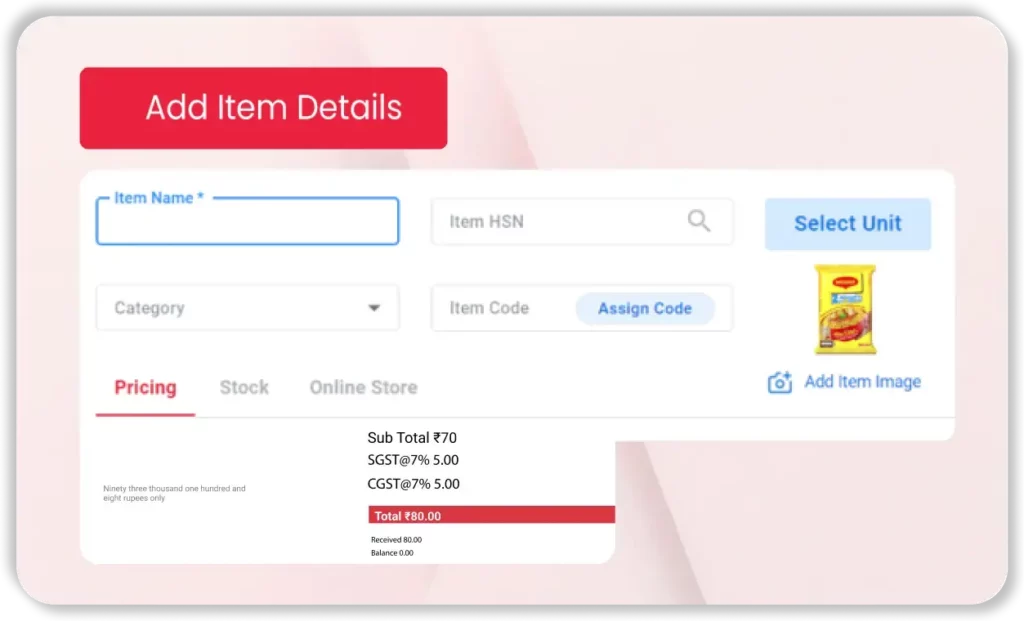

4. Add Items

- Click “Add Item” and enter the product or service details.

- Include item quantity, price, and any necessary attributes like batch number or serial number.

5. Preview and Save

- Review the challan for accuracy and click “Save”.

- You can print or share the challan via email, WhatsApp, or other channels directly from the app.

Get a Free Demo

Valuable Features of the Vyapar Challan Book App

Create and Manage Delivery Challans

Effortlessly generate professional delivery challans tailored to your business needs. Vyapar helps you easily create documents that align with your brand for a seamless customer experience.

- Add your company branding to challans for a professional look.

- Generate delivery challans quickly to save time.

- Maintain a uniform style for all delivery documents.

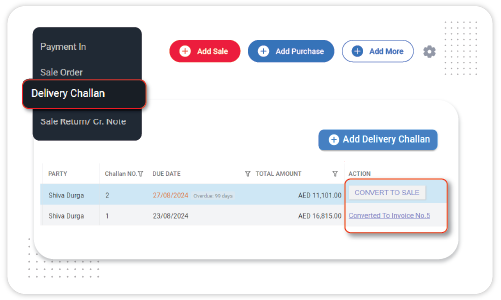

Convert Challans to Invoices

Convert delivery challans into GST-compliant invoices to simplify the billing process. This feature ensures smooth transitions from delivery to payment with minimal manual work.

- One-click conversion from challan to invoice.

- GST compliance for seamless financial documentation.

- Reduce manual data entry errors.

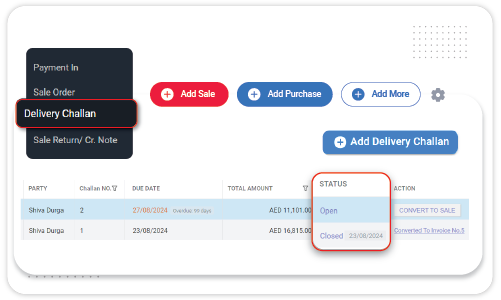

Track Delivery Challan Status

Monitor the status of delivery challans in real-time for better visibility into your operations. Keep everything organized and ensure timely conversion without missing important updates.

- Track challans as pending, completed, or invoiced.

- Real-time updates for effective management.

- Ensure timely conversion of delivery challans.

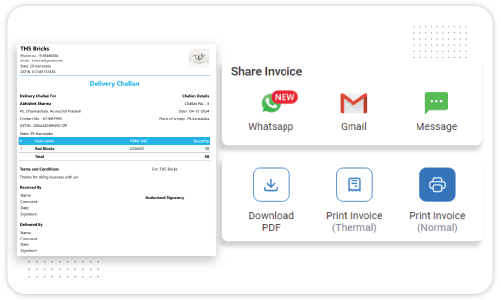

Print and Share Challans Easily

Vyapar allows you to print and share delivery challans effortlessly, providing you with multiple options to suit your business’s communication needs.

- Print challans directly from Vyapar.

- Share via WhatsApp, email, or digital platforms.

- Choose between thermal or laser printer output.

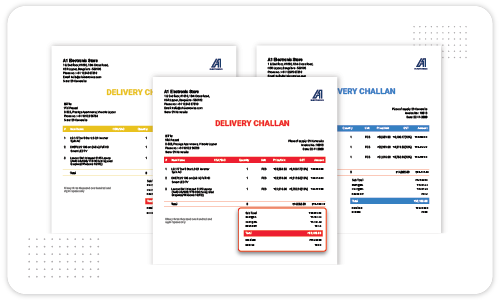

Multi-Format Challan Support

Create delivery challans in various formats to match different business requirements. Whether it’s GST or non-GST, Vyapar ensures compliance in the format that fits best.

- Create GST and non-GST delivery challans.

- Choose a suitable format for each transaction.

- Stay compliant with tax requirements effortlessly.

Benefits of Creating Delivery Challan in Vyapar App

Build a Positive Brand Image

Using the Vyapar delivery challan software, you can provide customised professional quotes to your clients, which builds a positive brand image. Your delivery challan can include our company’s logo, style, font, and brand colours.

An expertly created custom invoice can help you stand out from the competition. A buyer will likely purchase from a seller who uses expert custom quotation formats instead of plain text.

A custom challan can contain all the details required to close the deal. The information in the quotes may include details about the goods or services, price breaks, taxes, and terms of sale.

Track Business Status

Manage your company’s payments, open orders, inventory status, and cash flow all in one place. Using Vyapar’s business dashboard, you can streamline your whole management process.

With our business accounting software and invoicing tools, you can manage your business while on the go. With the help of this free billing software, accounting in your company is made very easy and effective. You can always receive thorough updates on your company.

The GST billing app aids in the analysis of your overall business operations. Using the observations, you can alter your business strategy whenever you want. It guarantees the smooth operation of your company.

Provide Multiple Payment Options

Using the Vyapar invoicing app, you can create invoices with various payment options. Your clients can pay you in the usual ways, like bank transfers (NEFT, RTGS, IMPS).

To make it easier for your customers to send a payment to the UPI ID attached, you can generate a QR code and include a QR code as one of the payment options within the invoice.

You can also accept cash, checks, debit cards, and credit cards. It will allow you to extend your customers better credit and entice them to do business with you more frequently.

Online/Offline Billing

You can continue running your business despite poor internet connectivity by using various features in the simple delivery challan maker app. You can use offline billing software to accept payments in your retail business.

For India’s remote locations, cash and eWallets are ideal because they do not require a connection to the internet. Additionally, you can create invoices for your clients offline using the Vyapar app.

Our business accounting software automatically validates and updates your transactions when you connect your database to the internet. Using our software, you can produce invoices for your customers as soon as they purchase.

Simple and Time-Saving

There is no need for specialised accounting knowledge to use the Vyapar software. The app’s user-friendly interface makes it simpler for users to use different challan formats.

The Vyapar app automatically records your transaction data. You can analyse your company and check the reports quickly. In Vyapar, any team member can manage transactions.

Manual bookkeeping is time-consuming and prone to error. Using the automated software from Vyapar will help you avoid this problem. The required reports will be accurately generated by it.

Access Features for Free

For Android users, the Vyapar app’s basic plan is free. You don’t have to pay to use the necessary features and accounting tools. At Vyapar, we strive to give our customers the best service possible.

Our mission to include millions of small business owners in the digital economy includes providing free access. Vyapar simplifies the management and scaling of business operations.

The accounting app for Android is available from the Play Store for free download and registration. You can, however, sign up for a subscription to gain access to the paid features and desktop applications.

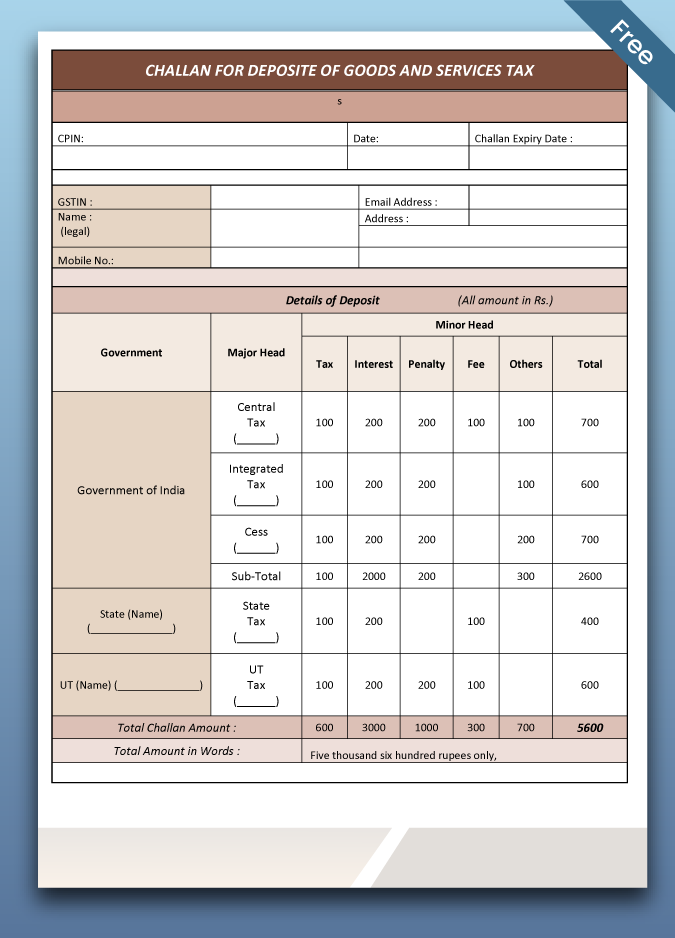

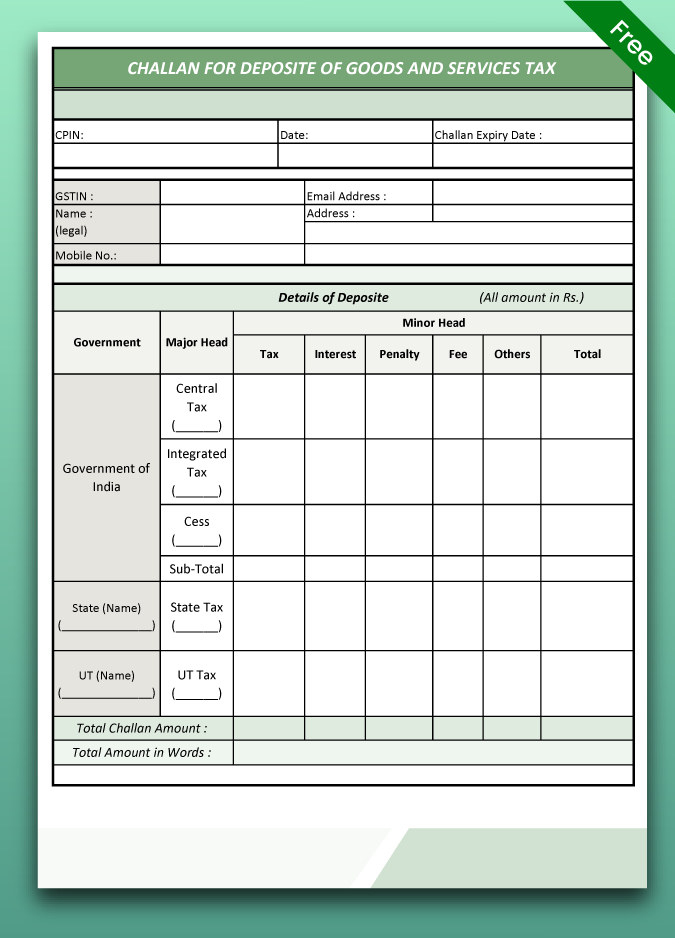

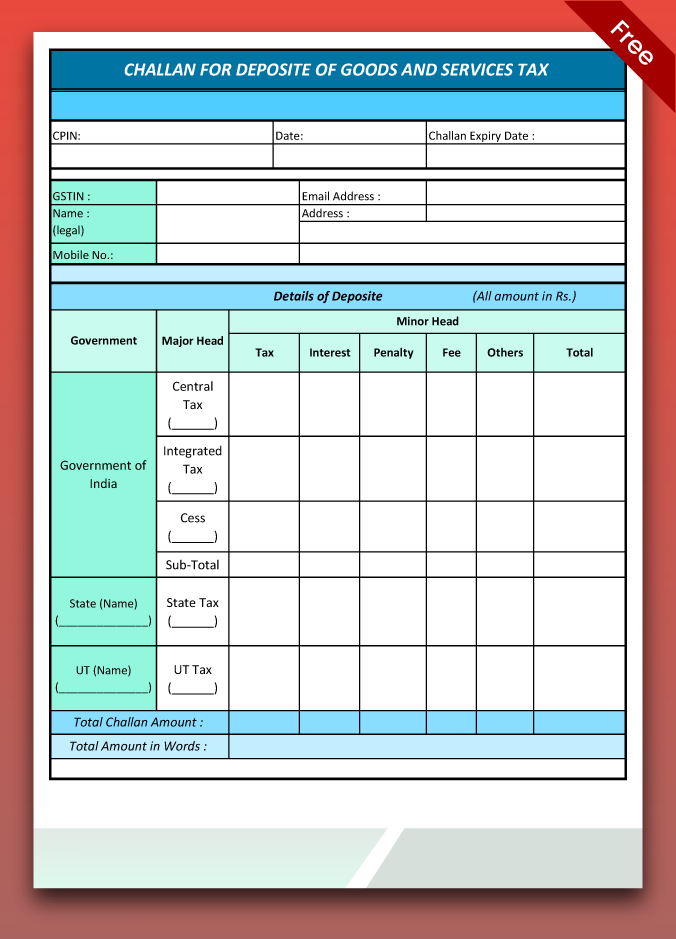

What are the Various Types of GST Challans?

1. Material Delivery Challan

Material Delivery Challan Format or Inward Delivery Challan is a document mainly used to receive the customer’s raw materials, record materials sent for the job, and track the finished product.

There are cases wherein issuing a material delivery challan is acceptable. The cases are mentioned below:-

- When the goods are transported abroad for exhibitions or promotions.

- When the transportation of goods takes place on an approval basis.

- A material delivery challan is required when a work of art is transported to galleries.

2. Banking Challan

A banking challan is an official document or the form used to credit money from one account to another. It is similar to a deposit slip available in the bank. It can be used to deposit money into someone’s account in cash or by NEFT/RTGS. The bank challan is generated by a merchant or an institution for paying fees.

3. Tax Challan

Tax challan is a simple form or document used to pay taxes to the government. Tax is deposited in authorized banks and not directly with the Income Tax Department. The tax challan can be paid directly through net banking.

4. Delivery Challan

A delivery challan is a formal document generated in situations where the goods are transported from one place to another. This transport of goods may or may not result in a sale or return basis. The material delivery challans are sent along with the shipment of goods. For example Transfer of goods from the Head office department to its several branches.

5. E-Challan

An e-challan is a computer-generated challan. It is issued against the traffic violations committed by any motor vehicle. It is the electronic form of challan. The officer concerned or the traffic police in charge may assign the e-challan. It comes along with the penalty amount mentioned.

Take Your Business to the Next Level with Vyapar! Try it for Free!

Frequently Asked Questions (FAQs’)

A Challan is a document used in many professional requirements with a wide range of use cases. This document represents a form of important document involved in various financial transactions.

In simple words, a Challan can be defined as an essential document, a receipt of an acknowledgment, a document of proof, necessary paperwork, etc., which is used to fulfill part of various financial transactions.

You can create a Challan Format in PDF, Word, and Excel and customize them. You can use Vyapar for GST challan generation and download the best challan copy for your customers.

The format includes the consignor and consignee’s name and address. Mention the GSTIN if registered. HSN code for the goods. The product’s HSN code.

You must make three copies of the delivery challan per rule 55(2) of the CGST Act.

Original copy – For the Buyer

Duplicate copy – For the Transporter

Triplicate copy – For the Seller

A delivery challan is generated when you must send goods or capital goods; however, GST does not apply in this situation. Therefore, a delivery challan records the number of goods delivered and serves as proof when payment is not made at the time of supply.

The movement of goods up to a distance of 20 km does not require an e-Way bill. After implementing GST, sending the e-Way bill with the Delivery Challan is necessary.

A tax invoice carries legal obligations and serves as proof of ownership. Contrarily, a delivery challan has no legal obligations and offers no evidence of ownership.

Yes, delivery Challan will work as an e-Way Bill. Any registered taxpayer or transporter may generate an e-way bill on the delivery challan using the GST portal.

A seller gives the buyer a delivery challan when delivering goods. A sale may or may not arise out of these goods.

A delivery challan is a document that contains details of the goods being transported from one place to another, which may or may not result in a sale. A delivery challan usually includes the following information:

– Date and challan number.

– Name, address and GSTIN of the consignor and the consignee.

– HSN code, description, quantity and rate of the goods.

– Taxable amount, GST rate and other taxes, if applicable.

– Place of supply for inter-state transport.

– Signature of the supplier or authorised person.

Yes. A delivery challan is a legal document that can sometimes be used for transporting goods without an invoice. Delivery challan is issued as per the provisions of Section 31 of the CGST Act and Rule 55 of the CGST Rules.

Delivery challan should contain the details of the goods, the consignor and the consignee, and the tax amount, if applicable. To ensure compliance, refer to the delivery challan format by the Vyapar app and customise it to meet your business-specific needs.

A delivery challan is sometimes issued when the supply of goods is not specific or complete, such as when the goods are sent for job work, exhibition, approval, or export promotion. Sometimes, a delivery challan is issued for transporting goods without an invoice.

Some common examples are listed below:

– Supply of liquid gas where the quantity is unknown at the time of removal.

– Transportation of goods for job work or reasons other than supply.

– Goods are sent on an approval basis or for exhibition or export promotion.

– Goods supplied where the invoice cannot be issued at the time of removal.

A delivery note and a delivery challan are documents used for transporting goods, but they differ. Here is a list of the main differences:

1. A delivery note accompanies a shipment of goods and provides a list of the products with quantity included in the delivery. A delivery challan contains details of the products in that particular shipment, which may or may not result in a sale.

2. The seller usually issues a delivery note to the buyer as proof of delivery and has no tax implications. The supplier issues a delivery challan to the recipient per the GST rules, which may have tax implications in some cases.

3. A delivery note does not affect the inventory levels of the seller or the buyer, as it is just a record of the goods delivered. A delivery challan affects the supplier’s inventory levels, decreasing the inventory stock when the goods are transported.

You can convert a delivery challan into a sales invoice once the shipment is delivered and the sale is finalised. All you need to do is make changes to the delivery challan details as finalised to create the final invoice for the customer.

To make the entire process faster, you can opt for the Vyapar app, which helps record the details of all delivery challans. You can make the necessary changes within minutes using the invoicing tools. Once done, you can share the sales invoice and collect payments.

As per the law, the taxpayer must raise a proper tax invoice for the taxable products, whereas he is free to issue a delivery challan for the transportation of non-taxable goods.

Yes, you can make an Excel delivery challan online using platforms with ready-made templates. Websites like Vyapar App offer different templates for download and personalize to fit your business.

Many businesses require invoices to include Excel capabilities for easy calculation and time savings. A delivery challan format is simple to create in Microsoft Excel. Select and customise the template that suits your requirements the most. You can create an outstanding challan for your customers in minutes using Vyapar’s free Excel DC templates.

A delivery challan is a legal document. It is required with the transportation of goods from one place to another.

In this situation, under the GST law, the transaction is not treated as a supply. It is issued only when you send goods. The GST does not apply to such transactions.

A seller usually issues a delivery challan in Word format to the buyer while the goods are delivered. These goods being transferred may or may not result in a sale.

According to the GST law, a tax invoice must be generated when any taxable material is taken out. The taxable material here denotes the material produced using the company’s raw material.

One crucial criterion of such taxable material is that there should have been some input tax credit on the raw material. Hence, it is under the law that the supplier generates a tax invoice. After that, the supplier collectively pays the tax mentioned in these invoices. However, certain situations exist when the material supplied is not meant for sale. In such cases, a tax invoice can not be generated. So, in these cases, the supplier can issue a delivery challan in place of a GST invoice.

A Returnable Delivery Challan is a document used when you send goods that are not meant to be sold but will come back later. It’s used for things like tools, samples, or equipment that are temporarily moved.

You use a Returnable Delivery Challan when sending items that need to come back, such as tools for repairs, items for testing, or equipment for demo purposes.

A Returnable Delivery Challan should have details like the sender and receiver names, description of items, quantity, purpose of sending, and the expected return date. It should also state that the goods are returnable.

No, a GST invoice isn’t needed for a Returnable Delivery Challan because the goods aren’t being sold. But GST details may be added if taxes apply to the transportation of those items.

Yes, with Vyapar you can easily create and manage Returnable Delivery Challans. It helps you add all the needed information, making the process smooth and well-documented.

A delivery challan is crucial in keeping track of items. The businesses that need PDF Challans are :

– Companies are involved in the trading of goods

– In cases where a single company transports items across various warehouses

– A supplier of goods and commodities

– A wholesaler

– A manufacturer