Debit Note Format

Vyapar will help you manage your company’s finances without difficulty. The main aim of the app is to make accounting accessible to everyone. So, if you are not interested in wasting time learning complex and highly advanced software, experience a 7-day trial at no cost – sign up now!

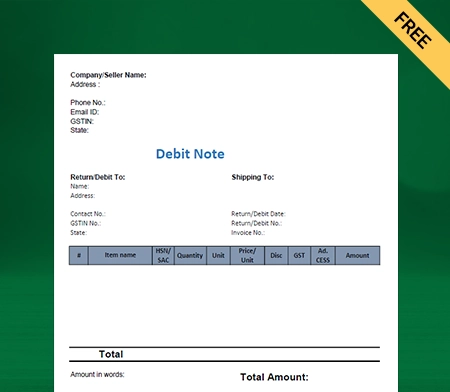

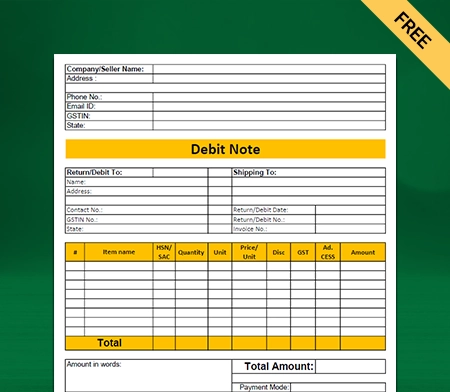

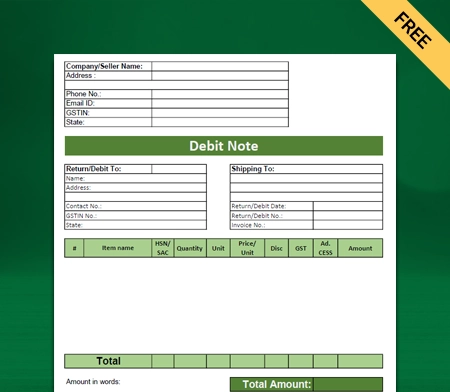

Download Debit Note Format in Excel, Word, and PDF

What is a Debit Note?

A debit note is a document issued from a buyer to a seller. A debit note confirms that a buyer has returned purchased goods or services to a seller. It serves as the buyer’s formal request for a credit note.

The cause may be incorrect, damaged goods received, or cancellation of the order. Debit notes indicate a purchase return in the buyer’s accounting books.

Reasons for Issuing Debit Notes:

A customer can issue a debit note if they purchase goods from a seller or supplier and want to return them for any valid reason.

A buyer initiates purchase return for goods when:

- The supplier delivers defective, damaged goods;

- The shape, size, or quantity is wrong;

- The supplier didn’t deliver goods or services on time;

- There are calculation errors in a bill;

- Suppliers charged higher taxes on goods or services;

- The buyer doesn’t want to purchase the goods or services.

The seller may also issue a debit memo in the following situations:

- When the seller needs to make adjustments to the invoice;

- When there is a change in billing amount;

- When a buyer increases their order quantity;

- To remind the buyer of their current debt.

Difference between Debit Note and Credit Note:

The invoice records the sale to a business and its client. A debit note informs a buyer of their current debt obligations. A seller creates an invoice when sales are made. A buyer creates a debit note when returning goods received on credit.

The invoice shows the total amount of the sales. The debit note will indicate the credit amount, the inventory, and the reason for returning the items.

An invoice records a sales transaction that has been completed. Debit notes provide information about past transactions that remain unpaid. A sales invoice is used when payment has already been made for the sale. Accounts receivable are the basis for debit notes.

How to create a debit note using the Vyapar App?

Open the Vyapar App. There are two options available to do the entry for debit notes.

1. Click on add more (+) button.

- You will find a purchase return option. Click on it.

- You can also use the shortcut key (Alt+L) to open the debit note format.

- Enter the customer’s details like name, date, and invoice number.

- Your return will get adjusted against that invoice.

- Next, you need to enter the details of the products that you are returning.

- The details include the name and amount of goods.

- Save the debit memo.

This method takes a lot of time, so Vyapar offers you an easy option. You can use it when you want to adjust a debit note to its specific invoice.

2. Go to the left menu.In the purchase section, click on the purchase option.You will see the list of all invoices.In the search bar, find the invoice whose product you want to return.You can perform the search by party name-wise, invoice number-wise, date-wise, amounts-wise, or invoice balance.The invoice will appear on your screen; click on the three dots.Click on the convert to return option.You will see that the debit note is already ready with all the required details.You can customize the item list as per your needs.Save it after making the necessary changes.

Benefits of using Debit Note Format by Vyapar:

Multiple Themes:

When you share professional invoices with your clients, it improves your brand image and identity. Our Vyapar software consists of two invoice themes for thermal printers and twelve for regular printers.

You can customize the invoice, quotes, and notes per your client’s needs. Also, you can manage your inventory and choose the best themes and GST formats through a single app.

Offline Access:

Accessing most accounting software in remote areas without the internet is challenging. You don’t need internet access or connectivity to use the Vyapar App because it is an offline application that you can use anywhere.

Also, the offline feature ensures the safety of your data. It keeps the data accessible only to the user. So, third parties and even Vyapar can not access it.

Saves Time:

Manual bookkeeping takes a lot of time and is prone to human error. You can avoid this problem by opting for the automated software of Vyapar.

The Vyapar app automatically records all your transaction data and generates reports. You can quickly review the statements and analyze your business. Anyone in your team can manage the software.

Easy to use:

You don’t need any special accounting knowledge to use the Vyapar software. The app’s user-friendly interface makes it easier to use. You can instantly access the data from mobile to desktop and desktop to mobile.

The user can use Vyapar for GST registered or unregistered entities. It will generate the reports you need with accuracy.

Instant Inventory Status Check:

You can keep track of your inventory and receive alerts when certain stocks run low. With Vyapar, it is easy to track all orders and inventory in a single platform digitally.

You can also use Vyapar’s powerful stock control system to gain visibility into your operations process. Users can import items and stock information from Excel sheets.

Payment Recovery System:

With Vyapar, you can set up your payment gateway to receive payments efficiently. This GST app keeps track of unpaid bills and invoices. Also, Vyapar can set and send payment reminders to customers.

You can minimize your outstanding debts and ensure faster collections. The software allows you to collect balances and improve your cash flow.

Importance of Debit Note under the GST Law

The GST law allows debit note issuance in two situations:

(a). A change in tax rates after the invoice has been issued.

(b). A change in the taxable value of the goods or services after the invoice is issued.

A debit note forms part of the details concerning GSTR-1, the month in which the supplier supplied the goods. The exact details are part of the recipient’s Form GSTR-2A and GSTR-2B. Once the verification is done, the recipient can accept it and submit it as part of his GSTR-3B.

Earlier, citing the original invoice number was mandatory while reporting a debit note. It must be quoted on the GSTN portal in Form GSTR-1 and Form GSTR-6.

However, the amendment regarding delinking of debit notes from their original invoice states that:

1. The issuer can provide the place of supply for a particular debit note to identify the supply type.

2. Entering the tax amount is sufficient when the debit note is issued because of the difference in the tax rate.

The delinking amendment also impacted the treatment of Input Tax Credit (ITC) for debit notes. The time limit for availing of ITC was the invoice date before the amendment. However, after the amendment, the time limit for availing of ITC is now computed per the debit note issue.

Time limit to Issue a Debit Note:

Generally, a buyer can issue a debit note at any time. As per Section 34(2) of the CGST Act, a buyer can give a debit note at the earliest of the following: On or before 30th September

Or

On or before the date of filing the annual return

If the buyer does not issue a debit note within the stipulated period, the tax liability, interest levy, and penalties will increase.

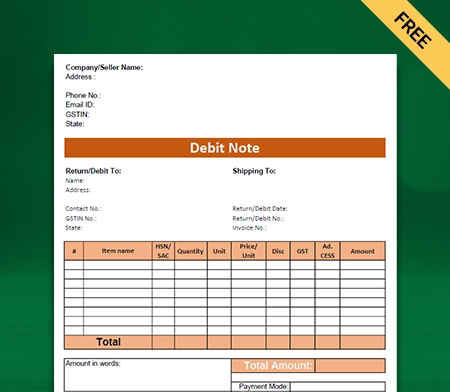

What Are The Contents Of Debit Note Format

There is no prescribed credit note format under any law. However, a debit memo must consist of the following details:

- The word “Debit Note” should be mentioned

- Name, address, and contact details of the buyer

- A unique serial number (16 digits)

- The issuance date of the debit note

- Invoice details

- Supplier’s name, address, GSTIN and contact details

- The total value of goods or services and tax rate

- Signature of supplier or their authorized representative

Create your first invoice with our free Invoice Generator

Other essential features of the Vyapar App

Accounting Management

Using our free software, you can easily manage your company’s accounts. It enables you to generate quotations, estimates, and accurate GST invoices. The app’s billing software allows you to convert invoices into debit notes easily. You can then share with your prospective party directly through the app.

Our advanced GST billing software makes creating sales or purchase orders simple. You can easily set due dates and track your orders. Furthermore, the user receives an auto stock adjustment to help ensure inventory item availability. It assists in the timely fulfillment of orders and increases customer satisfaction.

The auto stock feature of the Vyapar assists you in maintaining sufficient reserve stock to fulfill the order. You can use and convert your bills into any format suitable to your needs. Vyapar offers several options, including Word, PDF, and Excel. Using our GST invoicing software, you can save time creating debit/credit notes and invoices.

Receivables and Payable

Users can keep track of their business cash flow and all transaction details with the free Vyapar software. All your transaction details are safe and secure. You can track party-wise receivables and payables. Moreover, you can also generate debit and credit notes directly through invoice details.

The dashboard of the app is organized, efficient and attractive. You can track your dues and debts through it. Additionally, you can set payment reminders and send them to your clients who haven’t paid yet. Save time by sending payment reminders to all your customers at once with the bulk payment reminder feature.

The software performs automatic calculations and adjusts purchase returns against debit notes and sales returns against credit notes. You can revisit your business plan when it indicates early signs of cash flow issues. You can also perform party-to-party balance transfers with the Vyapar billing app.

Delivery Challan

Vyapar’s “Delivery Invoice” serves as an acknowledgement of delivery. Users can create delivery challans and attach them to their consignment using the app. It ensures that your goods arrive at their destination safely. The app allows you to track your shipment easily and provides instructions if it goes missing.

This ultimate free invoicing software helps the consignor manage the consignee details effortlessly. You can state the terms and conditions of the order beforehand to ensure clarity. It helps the business run smoothly, and the consignments can safely reach customers. It is also very efficient to convert delivery invoices into bills to help adjust auto stock.

Keep track of all delivery acknowledgements using GST billing and accounting software. It’s a simple way to run a business with high productivity goals. When the shipment arrives at the customer, you can use Vyapar’s free billing app to convert your delivery invoice into an invoice. It will enable you to receive payments in various ways, avoiding late payments.

GST Invoicing / Billing

Our customizable free GST billing software is an excellent addition to your company. It assists you in automating your billing needs and saving time in accounting. Business owners can perform a variety of tasks with the help of free billing software. They can file GST returns, manage inventory, and make invoices and bills more efficiently.

Business owners can customize the fields of invoices as per their unique requirements. You can generate invoices within 20 seconds and print and share them with your clients through WhatsApp or email. If you want to speed up your billing process, you can use the barcode scanner and shortcut keys.

One of the essential features of the Vyapar App is “Bill wise payment”. It allows you to link your payments to your sales invoices easily. The free GST Mobile App enables multiple parties to manage each client separately easily.

This feature makes it easy to track all the due dates of challans and track old challans at any point in time. The Vyapar App enables any business to identify any overdue payment quickly.

Automatic data backup

The Vyapar app is completely secure, and you can accurately store your data. To keep your data safe, you can create local, external, or online Google Drive backups with our free app. Also, it is easy to recover the data using the software. The data is encrypted for extra security.

If you are using the offline version, you must enable the auto-backup feature to get the backup on your registered email id. The “auto-backup” feature of Vyapar makes backups simple. When you enable this mode on the Vyapar app, an automatic backup is created daily. They offer various backup options- Local Drive, Google Drive, and email.

The app has an encryption system that keeps the data accessible only to the owner. You can use the app to create data backups based on your needs and help ensure the security of your data by using multiple backup options. Any third party or even our team cannot access your data.

Frequently Asked Questions (FAQs’)

Debit Note Format is issued to make changes in the previously issued invoices. The invoice may require changes for errors in the invoice, excess goods supplied, or goods returned due to defects or other reasons.

You must include the followings:

-> Customer’s information

-> Your company details

-> Items description, quantity, and price

-> Debit Note Number

-> Original Invoice Number

The debit note is the source document for the Purchase returns journal. Businesses usually use debit notes to extend credit to other businesses.

A debit note or debit memo is a commercial document generally issued by a buyer. A vendor may also issue the debit note in some instances.

E-invoice is necessary only for the credit and debit notes under Section 34 of the CGST/SGST Act. Financial/commercial credit notes without GST do not require e-invoicing.

A debit note contains the reason for the return of goods. The reason could be an invoice error, a damaged or incorrect item, a cancelled purchase, or any other circumstance.

Yes, a debit note is another form of purchase return of goods.

Using this online software, you can create debit/credit notes for products/services. It allows you to bill your customers directly from your Android device and send them the invoice via WhatsApp or email.

A debit note format typically includes:

-> Header: Business details, debit note number, and date.

-> Recipient Details: Name, address, and contact information.

-> Reason for Issuing: Explanation of the debit note (e.g., returns, adjustments).

-> Reference: Original invoice number or transaction reference.

-> Itemized List: Products/services, quantities, original amounts, and debit amounts.

-> Total Debit Amount: Sum of all debit amounts.

-> Payment Details: If applicable, specify payment method and any relevant details.

-> Terms and Conditions: Include any relevant terms or conditions.

-> Authorized Signature: End with an authorized signature or stamp.

A debit note is a formal document used in business transactions to notify a buyer about an increase in the amount payable or a debit in their account. It serves as a communication from the seller to the buyer regarding adjustments, returns, or additional charges related to a previous transaction. The purpose of issuing a debit note is to update the buyer about changes in the amount owed, such as adjustments for damaged goods, returned items, or corrections to previous invoices.

A debit note is typically issued by a seller or supplier to a buyer or customer. It is used to inform the buyer about an increase in the amount payable or a debit in their account due to adjustments, returns, additional charges, or corrections in a previous transaction.

A debit note is called so because it represents a debit or increase in the amount payable by the buyer or customer. It is used to inform the buyer about adjustments, returns, or additional charges that lead to an increase in the amount owed to the seller or supplier. The term “debit” in the name refers to the accounting concept of recording an increase in liabilities or amounts owed, which is reflected in the debit note issued to the buyer.

The key elements of a debit note include:

-> Date of issue.

-> Debit note number.

-> Seller’s and buyer’s information.

-> Reason for issuing (adjustments, returns, etc.).

-> Reference to the original transaction.

-> Itemized list of items/services.

-> Debit amount.

-> Payment terms.

-> Authorized signature.

To make a debit note in Tally:

-> Open Tally and select the company.

-> Go to Accounting Vouchers or press F9.

-> Choose Debit Note voucher type (Ctrl+F9).

-> Enter details like debit note number, date, party’s name, reasons, reference, item details, and debit amount.

-> Save (Ctrl+A) and accept the entry.

-> Print or export as needed.