Billing Software For Startups

Manage your invoices, payments, and expenses effortlessly with our user-friendly software. Unlock your business’s financial potential and focus on growth with Vyapar billing software for startups.

What is Billing Software For Startups?

Billing software for startups is designed to help small businesses and startups manage their invoicing processes more efficiently. It streamlines the generation, delivery, and tracking of invoices. It allows businesses to get paid faster and keep their finances organised.

Instead of doing it all by hand, the software calculates how much money your customers owe you and creates neat and professional-looking invoices for them. It also helps you track when payments are due and remind your customers to pay on time.

Why Use Billing Software For Startups?

1. Less Paperwork, More Time:

Billing software helps startups avoid the hassle of paperwork and manual calculations. Small businesses can save time and money. Digital invoices and payments can be securely stored in the billing software or cloud platforms. It reduces unnecessary clutter and the risk of losing important paperwork.

2. Get Paid Faster:

When you send invoices through software, your clients receive them quickly. You can get paid faster. Billing software for startups reduces delays and human errors. It allows you to promptly send professional and detailed invoices to clients via email or other electronic methods, expediting delivery. It improves your cash flow and financial stability.

3. Look Professional:

Billing software for startups adds a professional touch to your bills. It makes your startup look more credible and trustworthy to clients. Billing systems provide professionally designed and branded invoices. The software allows for customisation of invoice templates with your logo, company details, and payment terms, giving a cohesive and polished appearance. It gives a good impression and enhances your reputation.

4. No More Math Mistakes:

The software does all the math for you. It reduces the chances of errors in your invoices. This means accurate billing and no confusion with clients. It eliminates manual data entry errors. You can maintain a centralised database of customer and product information. It ensures consistency and accuracy in billing.

5. Know Your Finances:

Billing software can provide reports and insights into your finances. You can easily see how much money is coming in and track your business’s financial health. Billing software for startups provides real-time insights into revenue generation, outstanding payments, and expenses. The software’s tracking capabilities streamline financial management. It ensures a clear picture of the company’s financial position.

6. Keep Taxes In Check:

The software helps you calculate and manage taxes correctly. It keeps you compliant with the law and helps you avoid tax troubles. It automatically applies the appropriate tax rates to invoices, ensuring accurate tax calculations. It generates tax reports, simplifying the process of filing taxes for all and ensuring compliance with all tax regulations.

Contents That Should Be Included In A Bill Made By Startups:

A startup bill should include the following key features to ensure clarity and professionalism:

Invoice Header:

The top section of the bill should clearly state that it is an “Invoice” or “Bill” for the specific transaction.

Company Logo:

Incorporate your startup’s logo on the invoice to enhance branding and professionalism.

Invoice Number:

A unique invoice number helps provide a unique identification number to the invoice for tracking and reference purposes. This number should be sequential and help in organising your billing records.

Date:

Include the date on which the invoice is issued by the seller. It is the date when the bill is sent to the client.

Due Date:

Specify the payment due date, indicating when the client should pay. It helps in managing cash flow and ensures timely payment.

Startup Information:

Include your startup’s name, address, contact information, and other relevant details, such as the registration or tax identification number.

Client Information:

Provide the client’s name, address, and contact details. It ensures that the invoice is addressed to the correct recipient.

Description Of Goods Or Services:

Clearly describe the goods or services provided to the client. Be specific and itemise each product or service with its corresponding quantity, rate, and total amount.

Unit Price And Quantity:

Include the unit price of each item and the quantity sold. You can multiply the unit price by the quantity to calculate the total amount for each line item.

Subtotal:

Sum up the total amounts of all line items to calculate the subtotal before taxes.

Taxes:

If applicable, clearly state the taxes charged, such as GST, VAT, or sales tax. Include the tax rates and calculate the tax amount separately.

Total Amount Due:

Provide the total amount due, which is the subtotal sum and taxes (if applicable). It is the final amount the client is required to pay.

Payment Terms:

Include specific payment terms or conditions, such as accepted payment methods (credit card, bank transfer, etc.) and late payment penalties or discounts.

Additional Information:

Add any relevant information or notes about the specific transaction, such as special terms or project details.

Terms And Conditions:

Optionally, include a link or reference to your startup’s terms and conditions, especially if it contains important information about payments, refunds, or liabilities.

Contact Information For Queries:

Provide contact details or a designated person to handle any queries related to the invoice.

This way, you can create a clear and comprehensive document that facilitates smooth payment processing and minimises misunderstandings between you and your clients.

Things You Should Consider Before Choosing Billing Software For Your Startup

When choosing billing software for your startup, several important factors must be considered. You must ensure that the billing app meets your specific business needs and that it can streamline your invoicing process effectively. Here are some key things to look for:

Ease Of Use:

The software’s interface should be simple and easy to use. As a startup, you might lack the resources to learn difficult software or train your team. Look for billing software that lets you get your business up and running quickly without extensive training.

Invoicing Features:

Check if the software offers a variety of customisable invoice templates. Does it allow you to include essential details such as itemised descriptions, taxes, discounts, and payment terms? It should also support recurring billing if your startup deals with subscriptions or regular services.

Payment Integration:

You must ensure that the billing software for startups supports multiple payment gateways to offer your clients various ways to pay, such as credit cards, bank transfers, and online payment services. The flexibility can improve your chances of getting paid on time.

Automation And Reminders:

Look for automation accounting features that send out recurring invoices automatically and can send payment reminders to clients with outstanding invoices. Automation can save time and increase the likelihood of timely payments.

Reporting And Analytics:

The software should provide useful reports and analytics on your billing data. It should show you outstanding payments, revenue trends, and other financial metrics. These data insights can help you make informed business decisions with detailed business reports.

Scalability:

Consider whether the billing software can grow with your startup. As your business expands, you’ll want a solution that can handle an increased volume of clients and invoices without performance issues.

Integration With Accounting Software:

If you need accounting software for startups or plan to implement one in the future, ensure that the billing software for startups comes with integrated accounting software. This integration will prevent duplication of data entry and streamline your financial processes.

Security And Compliance:

Data security is crucial for every business in India, especially when dealing with personal financial information. Check the security measures implemented by the billing software for startups to protect sensitive data. Additionally, ensure the software complies with relevant regulations and industry standards.

Customer Support:

Good customer support is critical to a large number of businesses, especially if you encounter issues with the software and need immediate assistance. Check the level of customer support provided by the billing software provider.

Cost And Pricing Structure:

Evaluate the pricing plans offered by the billing software provider. Some may charge a flat fee, while others might use a subscription-based model or charge per invoice. Consider how the pricing aligns with your budget and the value you get from the software.

Mobile Access:

If you and your team are frequently on the move, consider a billing software solution that offers mobile access through dedicated apps or mobile-friendly web interfaces.

Free Trial:

Whenever possible, opt for billing software for startups that offers a free trial period. It allows you to test the software. Before committing to a purchase, you can assess whether it suits your startup’s needs.

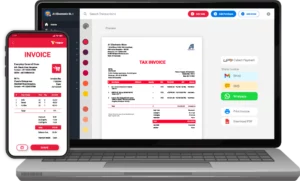

How To Make Bills Using Vyapar Billing Software For Startups?

Here’s a step-by-step guide to help you create a bill using Vyapar:

Step 1: Install And Set Up Vyapar Billing Software

- Download Vyapar Billing software from the official website or your app store.

- Install the invoicing software on your computer or mobile device.

- Open the app and complete the setup process by creating an account and providing basic company information.

Step 2: Add Customer Details

- Before creating a bill, you must add your customer’s information to Vyapar.

- Go to the “Customers” section and click “Add Customer.”

- Enter the customer’s name, contact details, address, and other relevant information.

Step 3: Add Item Details

- Next, you’ll need to add details of the products or services you provide.

- Go to the “Items” or “Products & Services” section and click on “Add Item.”

- Enter the item name, description, rate, and any other relevant details. This information will be used while creating the bill.

Step 4: Create A Bill/Invoice

- With the customer and item details set up, you can now create a bill.

- Go to the “Invoices” or “Bills” section and click on “Create Invoice.”

- Select the customer you want to bill from the dropdown menu.

- Choose the items or services you provided from the list of items you added earlier. Enter the quantity, and Vyapar will automatically calculate the total amount.

Step 5: Add Payment Terms And Notes

- You can add payment terms such as due date, payment methods, and any additional notes to the bill. This information ensures clarity for your customer regarding payment expectations.

Step 6: Preview And Send The Bill

- Once you’ve filled in all the necessary details, you can preview the bill to ensure everything is correct.

- If everything looks good, click “Save” or “Send.” If you choose to send the bill, you can do so via email or WhatsApp directly from Vyapar.

Benefits Of Using Vyapar Billing Software For Startups

User-Friendly Interface

Vyapar’s user-friendly interface makes it easy for small business owners to navigate and operate the software efficiently. People without extensive accounting knowledge can also use it effortlessly. The intuitive design lets users learn how to use its various features quickly.

Our well-designed user interface helps minimise the risk of errors in data entry and calculations. It includes features like auto-fill, auto-calculation, and validation checks. It prevents common mistakes and ensures accuracy in financial records.

Vyapar’s user-friendly interface is accessible across multiple devices. You can use the billing software for startups on desktop computers, tablets, and smartphones. It allows small business owners to manage their finances on the go. It provides flexibility and convenience.

Customised Invoicing And Billing

You can create customised invoices and bills. Customisation allows startups to incorporate their logo, brand colours, and unique design elements. This branding creates a professional and consistent image. It helps to build brand recognition among customers.

Startups can personalise invoices with customer names, special notes, or personalised messages. This professional touch can enhance the customer experience and foster better client relationships. It can instil confidence in customers and business partners.

Vyapar’s customisable invoicing features allow startups to include detailed breakdowns of products or services. It helps customers understand the invoice better. It reduces the likelihood of disputes and improves payment turnaround.

Cloud-Based Accounting

As a cloud-based solution, Vyapar allows startup owners to access their accounting data from anywhere using an active internet connection. This level of accessibility enables small business owners to stay on top of their finances and make timely decisions.

Our cloud-based accounting software is cost-effective for startups. There’s no need to invest in costly hardware or worry about maintenance and software updates. Startups can quickly scale their accounting needs up or down as their business grows or experiences fluctuations.

Vyapar’s cloud-based accounting software enables seamless collaboration between team members and accountants. Multiple users can work together using the same data, facilitating better teamwork and efficient communication.

Expense Tracking

Expense tracking through Vyapar provides startups with a clear and comprehensive view of their expenses. It helps them understand where their money is being spent. Startups can identify areas of high or unnecessary costs and make informed decisions.

Expense tracking can prevent overspending and helps maintain financial discipline. Vyapar allows startups to categorise expenses into different groups. The categorisation enables startups to analyse spending patterns and allocate funds appropriately.

Businesses can create and stick to budgets. Vyapar offers the option to store digital receipts and attach them to respective expenses. This feature helps with record-keeping, simplifies expense verification during audits, and reduces paper clutter.

Client Management

Vyapar billing software for startups provides a centralised database to store all client-related information. You can save contact details, purchase history, payment status, and communication logs. Having this data in one place makes it easy to access and manage client information efficiently.

The client management features enable startups to track all client interactions, including emails, calls, and messages. It ensures that the team can respond promptly to client inquiries and provide better customer service.

With improved client management, startups can focus on building strong, long-term relationships with their customers. Satisfied and loyal clients are highly likely to become repeat customers. Further, they can become advocates for your business.

Efficient And Time Saving

The user-friendly interface streamlines the billing and accounting processes for startups. It enables users to perform tasks quickly and efficiently. With easy access to various functions, small business owners can save time on everyday administrative tasks and keep running their businesses.

Vyapar streamlines the invoicing and billing process for startups. It makes everyday tasks quick and efficient. Startups can generate invoices with just a few clicks. It saves time on manual paperwork and calculations. Automation reduces manual intervention.

Key Features Of Our Billing Software For Startups

Payment Reminders

Vyapar billing software for startups allows users to set up automated payment reminders for their customers. It means that the software will automatically send reminder notifications to customers about pending payments on specified dates or intervals.

The Payment Reminder feature in Vyapar allows users to customise the content and tone of the reminder messages. Businesses can create polite yet firm reminders that maintain a professional relationship with customers while ensuring timely payments.

Users can track the status of payment reminders in real time. Vyapar provides notifications or updates when reminders are delivered, opened, or paid. It helps businesses stay informed about customer interactions and payment responses.

Late payments can create a financial strain for startups. Vyapar’s Payment Reminder feature helps reduce late payments by sending timely reminders. It can positively impact the overall financial health of the business.

Inventory Management

Vyapar allows startups to maintain a centralised and organised inventory database. Users can input details of their products, including product names, descriptions, stock quantities, unit prices, and relevant tax information.

Startups can track their stock levels in real time. Every sale and purchase transaction automatically updates the inventory count, providing a clear picture of available stock at any given moment. This real-time tracking helps avoid stockouts and overstocking issues.

The sale purchase billing software enables startups to create and manage sales and purchase orders directly within the system. This feature facilitates seamless communication with suppliers and customers, helping to maintain a smooth supply chain.

Vyapar barcode based inventory management software offers barcode integration. Startups can generate invoices and print barcodes for their products. It makes the process of tracking and updating inventory faster and more accurate. It allows businesses to trace products back to their specific batches.

Bank Accounts

The Bank Accounts feature in Vyapar allows startup owners to connect their business accounts directly to the software for effortless cash flow management. This integration streamlines financial transactions. It enables users to receive payments from customers directly into their bank.

Vyapar assists startups in reconciling their bank transactions effortlessly. Users can match payments received and expenses paid with corresponding entries in the software. This process ensures that the books accurately reflect the actual bank balance.

Bank reconciliation is a crucial accounting task ensuring financial records match bank statements. Vyapar simplifies this process by automating the matching of transactions. It saves time and helps reduce the likelihood of errors.

By closely monitoring bank account balances and transactions in Vyapar, startups can better manage their cash flow. Understanding incoming and outgoing funds helps make informed decisions and plan for the future.

Multiple Payment Options

Vyapar enables startup owners to offer their customers a range of payment options. Customers can pay using QR codes, Paytm Wallet, credit cards, debit cards, digital wallets, net banking, UPI, cash, and more. This way, startups can attract a broader customer base.

Customers appreciate flexibility in payment methods. With the Multiple Payment Option feature, startups can provide a seamless and hassle-free payment experience. It leads to a higher customer satisfaction score and repeat business.

Accepting multiple payment options ensures faster and smoother payment processing. Customers can pay through their preferred methods. It reduces the chances of payment delays due to limited payment choices.

By offering multiple payment options, startups can cater to a larger audience and avoid losing potential customers who might abandon their purchase if their preferred payment method is unavailable. It, in turn, can lead to an increase in sales and revenue for the business.

Data Security

The software implements secure access controls to limit access to sensitive information only to authorised personnel. It means that users can set different permission levels for various team members. It ensures that employees can only access the data necessary for their roles.

Vyapar facilitates regular data backups to prevent data loss due to technical failures, hardware malfunctions, or other unforeseen events. These backups are essential for quickly restoring data in case of data corruption or accidental deletion.

Professional billing software for startups uses encryption protocols to encode data both during transmission and storage. It ensures that even if data is accessed without authorisation, it remains unreadable and unusable by unauthorised parties.

Vyapar uses secure cloud storage to host user data. Cloud providers are renowned for their stringent security measures, including physical security, firewalls, and monitoring systems. It makes sure that data is stored in a safe and protected environment.

Reporting And Analytics

The Reporting and Analytics feature in Vyapar presents complex financial data in a visually appealing and easy-to-understand manner. Data visualisations like charts and graphs help startups quickly grasp critical information without delving into detailed spreadsheets.

Vyapar offers real-time reporting for business owners. It allows startups to access the most up-to-date financial information. Data-backed insights enable startups to make informed decisions. It reduces the risk of making uninformed choices that could negatively impact the business.

Startups can analyse sales data to identify top-performing products, customer segments, and sales channels. This information assists in devising effective marketing and sales strategies to boost revenue.

Understanding cash flow patterns is crucial for startups. Vyapar’s analytics feature offers insights into cash flow trends, helping businesses anticipate cash shortages or surpluses and plan accordingly.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

Billing software is a tool that automates invoicing, payment processing, and financial management for startups. It streamlines their billing operations and improves efficiency. For startups, professional billing software helps cover all everyday billing requirements.

Startups use billing software to streamline their invoicing processes as follows:

1. Helps ensure accurate and timely billing to clients.

2. Keep track of payments and reduces human errors.

3. Significantly improves financial management.

4. Billing software provides insights into revenue generation.

5. Enhances efficiency and professionalism in financial operations.

Yes. Vyapar billing software for startups supports multiple payment methods. It allows startups to offer diverse payment choices to their customers.

Yes, Vyapar is designed to be user-friendly, even for startups without extensive accounting knowledge. It makes it easy to manage finances and invoices.

Absolutely, billing software like Vyapar offers inventory management features. It helps startups monitor stock levels, track sales, and optimise inventory efficiently.

Yes. Vyapar billing software for startups offers customisable invoice templates. It enables startups to add their branding and tailor invoices to their specific needs.