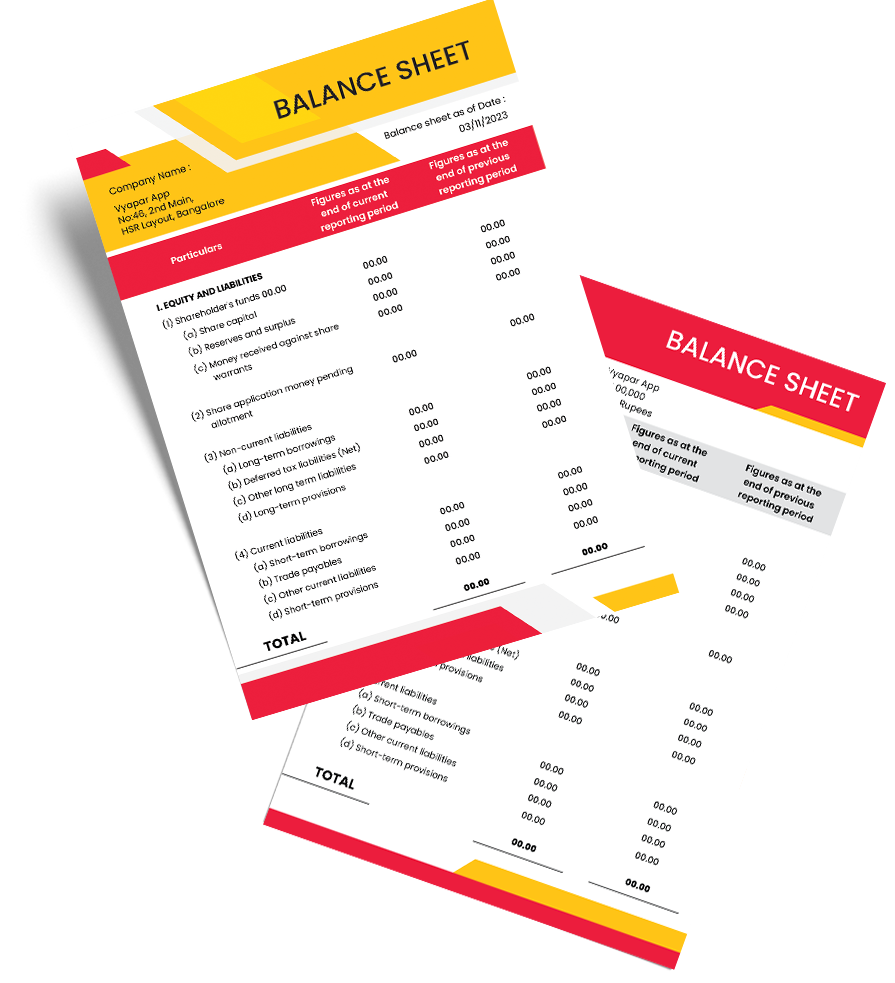

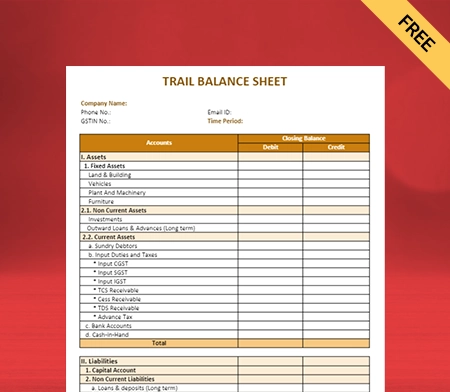

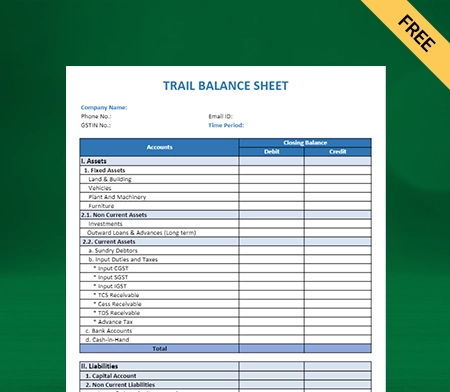

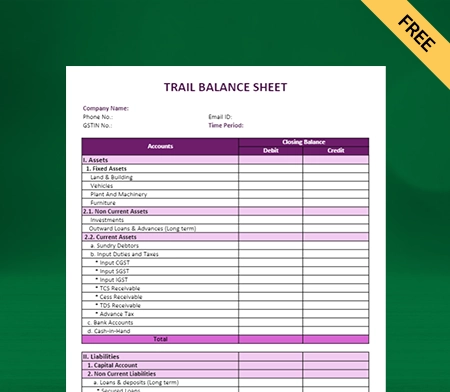

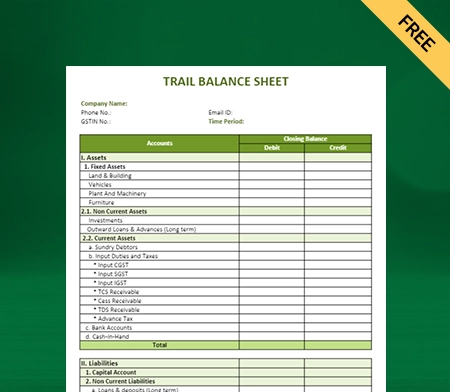

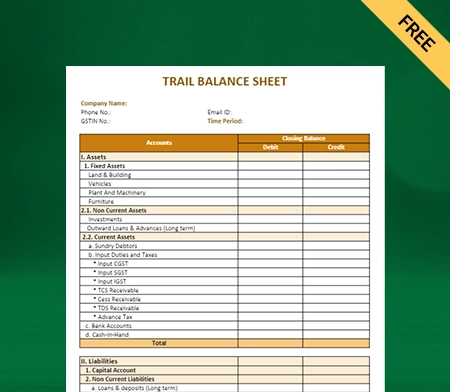

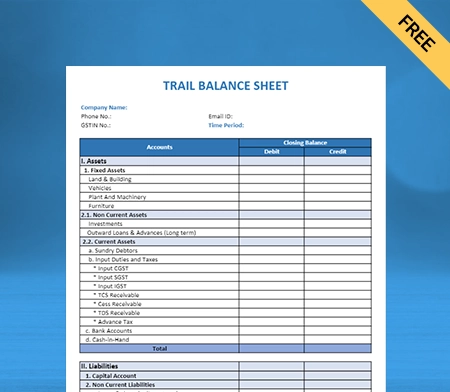

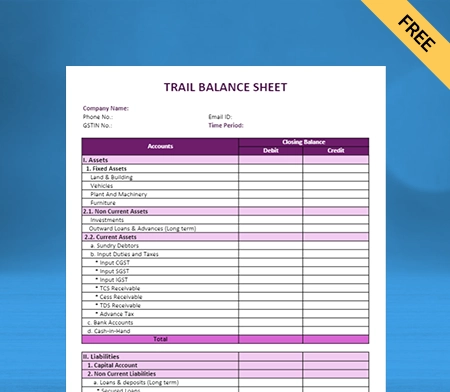

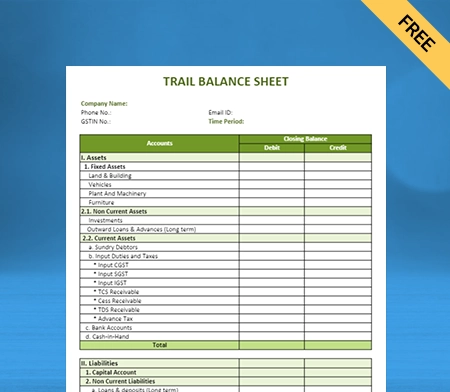

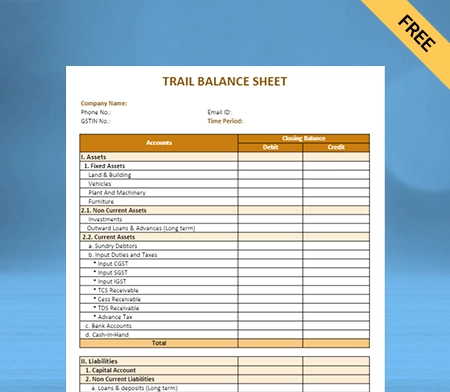

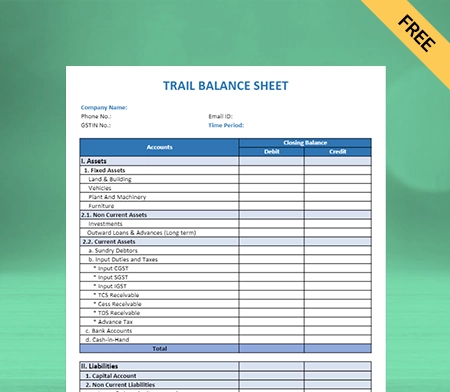

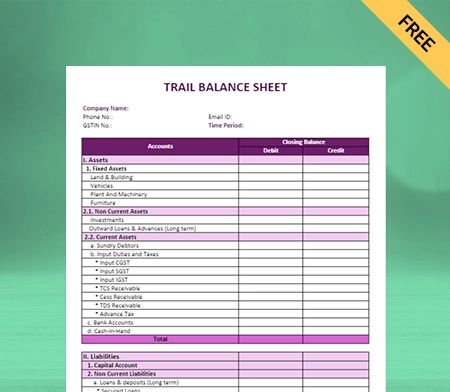

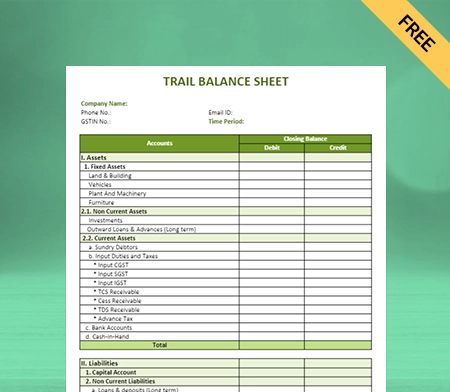

Trial Balance Sheet Format in PDF | Word | Excel

Vyapar simplifies trial balance sheets, saving you precious time. Download, analyze & generate 35+ reports instantly.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

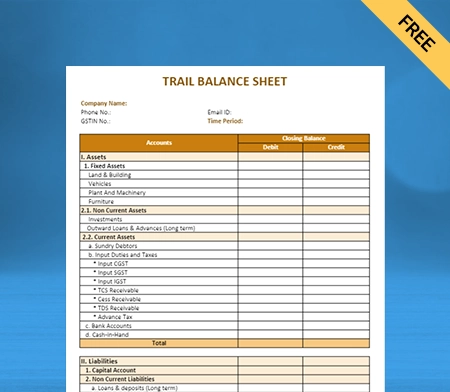

Download Trial Balance Sheet Format PDF

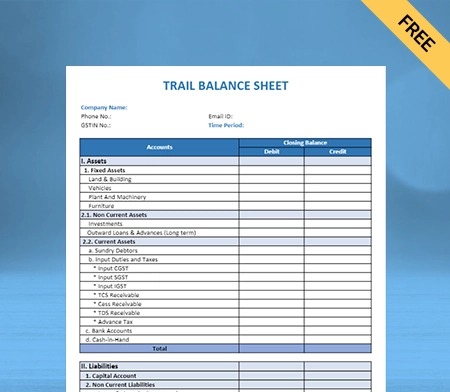

Download Trial Balance Sheet Format Excel

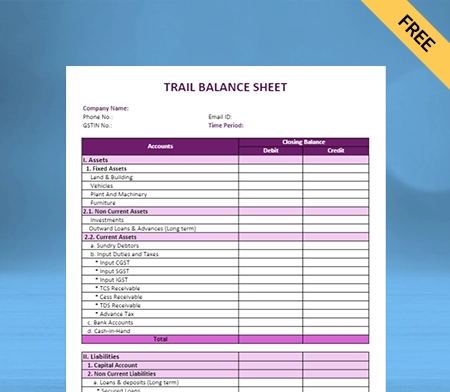

Download Trial Balance Sheet Format in Word

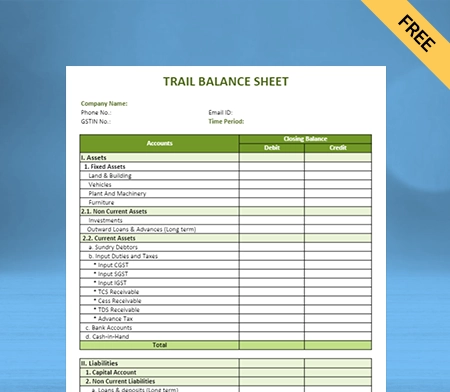

Download Trial Balance Sheet Format in Google Docs

Download Trial Balance Sheet Format in Google Sheets

What is the Trial Balance Sheet Format?

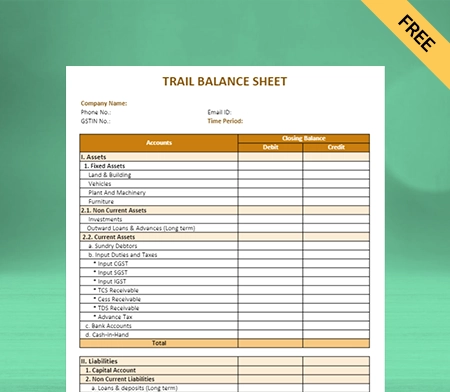

A Trial Balance Sheet is a financial statement showing the general ledger balances at a particular time. The free Trial Balance Sheet Format in pdf/excel/word by Vyapar makes it seamless for business owners to create balance sheets for their business requirements.

At the end of an accounting period, like a month or a quarter, the Trial Balance Sheet ensures that the total credit and debit sides are equal. It is the first step before making financial statements like income and Balance Sheets.

The Trial Balance Sheet Format saves the time and effort that would have been needed to check each account by hand. The data helps create other financial statements, like income statements and Balance Sheets, which makes reporting financial information effortless.

The Trial Balance Sheet also summarises the account balances, which can be used to make financial statements and decisions about the company’s financial health. It is vital to have a Trial Balance Sheet because it helps find mistakes in journal entries. If the total debits don’t equal the total credits, there must be a mistake in the records.

How to Prepare Trial Balance Sheets?

A Trial Balance Sheet should mention a business’s general ledger accounts, balances, and total debits and credits. To prepare a Trial Balance Sheet Format, a company can ensure its financial records are correct and find mistakes before putting together financial statements.

Here are the steps to prepare a Trial Balance Sheet

List Down All Business Accounts: This includes all the accounts in the company’s chart of accounts for assets, liabilities, equity, income, and costs.

Record the Balances: At the end of the accounting period, note down the balance of each account. Balances with debit sides get written as positive numbers, and balances with credit are written as unfavourable.

Find the Total Amount of Debits And Credits: Add up the balances of all the debits and all the credits separately, and write the totals at the bottom of the Trial Balance Sheet.

Verify the Equality of Debit And Credit: Ensure that the total number of debits equals the number of credits. If they don’t match, a mistake in the accounts books needs fixing.

Check Out the Trial Balance: Ensure all accounts are listed, and the balances are correct. Before you make the financial statements, you should look into any differences or mistakes and fix them.

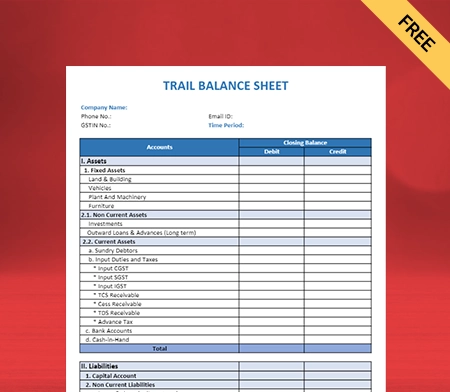

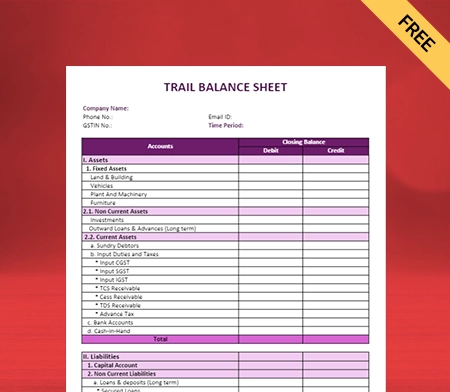

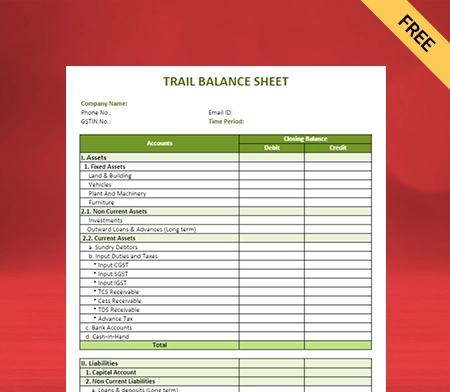

What Should We Include in the Trial Balance Sheet Format?

To make a Trial Balance Sheet, you need to include the following:

Account Names: Make a list of all the account names in the general ledger, and it should also mention the vital details such as the accounts payable and receivable, Business inventory, cash, and so on.

Account Numbers: Give each account in the general ledger a unique account number. It can assist clients in finding accounts and placing them in the correct order.

Balances in Credit And Debit Sides: A negative debit balance indicates that money is owed to the account, whereas a positive credit balance suggests the opposite.

Totals: Write the total of all the balances in each column at the bottom of each column. The debit and credit columns should both add up to zero. It shows that the total amount of money owed to and by the company is the same.

Date: Write down the date the trial balance was made. It helps figure out if there are any problems with the accounting records.

Name And Logo of the Company: Add the name and logo of the company to the Trial Balance Sheet so that it can be used as a brand and is easy to find.

Overall, the format of a Trial Balance Sheet should give a clear and accurate picture of a company’s opening and closing balance at a certain time.

Difference Between a Trial Balance Sheet And Balance Sheet

- The Trial Balance Sheet is an internal document that accountants use to check the accuracy of their records. On the other hand, the Balance Sheet is a financial statement that shows outside stakeholders how a company is doing financially.

- The Trial Sheet is typically prepared at the end of an accounting period, whereas the Balance Sheet is prepared after the fiscal year.

- The Trial Balance Sheet shows the balances of all accounts, both debit and credit, while the Balance Sheet only shows the balances of accounts at a specific date.

- The Trial Balance Sheet is usually laid vertically, with debit balances in one column and credit balances in another. The balance sheet is laid horizontally, as assets are placed on the left side of the balance sheet and equity on the right.

- The accounts on the Trial Balance Sheet get used to making financial statements, while the accounts on the Balance Sheet show the company’s financial position.

- The Trial Balance Sheet is vital to ensure the entire financial year records are correct. The Balance Sheet is essential for investors, creditors, and other people outside the company to determine how healthy and stable the company’s finances are.

Benefits of Using the Trial Balance Sheet

A Trial Balance Sheet Format is helpful for businesses because it provides a clear and organized overview of their financial information. A company can quickly find any mistakes and ensure its financial statements are correct by listing all accounts and their balances.

Here are some benefits of using a Trial Balance Sheet for businesses:

1. Helps Identify Errors:

The Trial Balance Sheet Format is valuable for businesses because it helps them find mistakes in their accounting records. By listing all the accounts and how much money is in each, the trial balance ensures that the total amount debited is the same as the total amount credited.

If there is a difference between the sum of the debit and credit sides, the transactions were not recorded correctly, or there is an error in the account balances. Organizations can verify their accounting period and records and make any necessary adjustments to ensure accurate reporting during the fiscal year.

2. Ensures accuracy:

The trial Balance Sheet Format is useful for businesses to ensure arithmetical accuracy in their financial year records. This format lists a company’s accounts and balances, allowing it to compare the total debits and credits easily.

By comparing the totals of the debit and credit balances, the trial balance helps to find any mistakes or discrepancies in the records. The company can ensure its financial records are correct and accurate by fixing these mistakes before finishing the financial statements.

3. Planning And Budgeting:

The Trial Balance Sheet Format is valuable for preparing budgets and projections. By examining their current financial status, firms can generate accurate estimates regarding their future income, expenses, and cash flow.

This information is used to develop comprehensive financial year plans that enable organizations to predict prospective obstacles and opportunities and make strategic decisions to achieve their objectives. By regularly assessing and revising their budgets and projections, firms may maintain agility and responsiveness in a dynamic economy, enhancing their prospects of long-term success.

4. Supports Decision-Making:

Using the Trial Balance Sheet Format gives your platform a better edge in decision-making. It summarises all accounts and balances, including equity, assets, and liabilities. It can assist your business platform significantly in important decision-making and assessing the company’s financial health.

Using the trial balance sheet format allows you to access the health of your business balance sheet quickly. Businesses may improve efficiency, reduce risk, and maximize profits with the help of this financial information.

5. Legal Meeting Requirements:

The Trial Balance Sheet Format is essential to a business’s financial reporting because it helps ensure the industry follows accounting rules and standards. This format summarises all accounts and their balances, making it easy to check that the financial year records are correct.

The Trial Balance Sheet Format is used to build more complex financial statements, like income and Balance Sheets, which are needed to give a complete picture of a company’s financial performance and position.

6. Facilitation of Adjusting Entries:

A trial balance is a tool used in accounting to ensure that a business’s financial records are correct. Two columns, debit and credit, list all the accounts and how much money is in each. Companies can make sure that their accounts are balanced by comparing the total balances of their debits and credits.

This format makes it easier to make adjusting entries, which helps companies make changes to their accurate financial statements. Adjusting entries make sure that income and expenses are recorded at the right time.

Features That Make Vyapar App Best For Your Business

Millions of small business owners use Vyapar for their everyday business requirements. Here are some reasons why you should also use Vyapar accounting software:-

Manage Your Business Cash Flow Seamlessly:

Vyapar software allows your business to keep track of money spent and received. It allows you to keep track of your business payments. Millions of business organizations in India have tried the features of our free accounting software.

You can also perform other essential operations, such as billing, accounting, invoicing, and other financial tasks, for healthy cash flow management. Vyapar’s software streamlines operations by removing manual tasks. Accounting errors can be avoided in this way. Investing in this billing software will allow you to easily monitor your company’s cash flow.

Creating a true cash book in real-time is more straightforward using our Vyapar software. It can aid your business in keeping cash flow steady and keeping track of the sums of money spent, received, and spent on various things. With this GST accounting software, you’ll easily manage your cash flow.

Record Your Business Expenses:

Using Vyapar software makes recording and tracking expenses easier and simpler for your business platform. You can easily file the GST and perform accounting operations by recording your expenses. You can keep track of financial statements without facing any difficulty.

The Vyapar solution to create professional invoices comes with several advantages over those offered by competitors. It helps you cut costs while simultaneously increasing sales. Free accounting software is an effective method for efficiently tracking overdue costs on time.

Vyapar software assists organizations in maintaining control over their financial situation. The organization can reduce wasteful spending by using the GST software to keep detailed records of their expenditures. It results in cost savings by cutting down the money spent on unnecessary tasks. Keeping an eye on expenses is also going to help develop better tactics. It will increase the overall profitability of your business platform.

Create Customisable Templates:

Using Vyapar inventory management software allows your business to create multiple pre-made templates. You can create professional-looking bills, invoices, estimates, quotations, etc., for your business platform.

Using the Vyapar software, you can add font styles and colors and add or remove rows and columns to make the templates fit your brand. You can save time and effort using templates you can change. It can validate your financial records to meet your business needs accurately.

Customizable templates enhance the customer experience and build customer support inside your business platform. It shows the personality and professionalism inside your business platform. You can create your template free of cost with all essential tools and techniques per your business requirement.

Create Multiple Reports:

Vyapar software allows you to generate as many customized reports as your business needs. You can generate balance sheets, P&L statements, and revenue and expenses broken down by invoice for your business.

It provides useful information, such as party reports, expense, and other income reports, to help you rapidly control the costs associated with running your business. You will receive periodic bank statements. It allows you to monitor all essential activities through multiple reports.

Vyapar also facilitates the management of related tax paperwork. By using Vyapar it becomes simpler for small and medium businesses to easily manage their business taxes by submitting the appropriate GST report (GSTR-1, GSTR-2, GSTR-3B, GSTR-4, and GSTR-9) to the Indian government as required. It can save time and money and save your business from tons of paper hassle.

Business/ Accounting Management:

With Vyapar small business accounting software, you can run your business as one entity or as a network of related businesses. Your organization’s ability to conduct business would be unaffected by whether or not it was legally formed. When you use Vyapar, you may access your business information quickly from any device or a group of devices.

If you’re looking for software that allows you to perform a wide range of operations, Vyapar is the best invoicing software. Millions of business owners use Vyapar to perform their day-to-day operations. You can also construct up to five subsidiaries within your main company.

You can use Vyapar for both GST and non-GST-related transactions. Using Vyapar accounting software, you can quickly and effectively generate and manage a wide range of tasks related to your business, like billing, invoicing, reporting, and more. You can also use its included business dashboard to get a bird’s-eye view of your company’s operations.

Online/Offline Software:

With the tools provided by our Vyapar software, you can continue operating your business operations even if internet connectivity is spotty. The offline accounting software is ideal for small businesses in rural India since it allows them to accept payments offline using methods like cash and eWallets.

Our GST accounting program will allow you to instantly generate balance sheets, Invoices, bills, reports, estimates and quotations, and delivery challan for your business platform. Vyapar’s online and offline capabilities are instrumental in rural areas with connection and network problems.

Customers appreciate the time-saving functionality of the accounting app, as they no longer have to wait in line. They can easily track all their transactions and update their real-time balance sheet information. You can use Vyapar’s professional features and tools for free.

Frequently Asked Questions (FAQs’)

A Trial Balance Sheet is a financial statement showing a company’s accounts and balances in two columns, with debits on the left and credits on the right. It ensures that the total debits and credits add up to the same amount. It helps identify areas for improvement in the accounting system.

There are two columns on a Trial Balance. The first column lists the company’s ledger accounts, and the second column shows their respective balances. Debit balances are in the left column, while credit balances are on the right.

An organization uses a Trial Balance Sheet to verify that its accounting system’s debits and credits are in equilibrium. It lists all accounts and their current balances, allowing you to check that the total of all debits and credits is the same.

You can use the Vyapar software to prepare your Trial Balance Sheet for free. You can easily and quickly prepare your Trial Balance Sheet as it already comes with all the essential details required for your Balance Sheet. One crore small business owners use Vyapar software to perform their day-to-day operations.

The simple format of a trial balance includes columns for account names or numbers, debit balances, credit balances, and a total to ensure equality between debits and credits.

To create a trial balance:

1. Gather ending balances from the general ledger.

2. List accounts and their debit or credit balances.

3. Calculate the total debits and credits to ensure they’re equal, indicating a balanced trial balance.

A trial balance PDF is a digital document in PDF format that presents a trial balance. It typically includes a list of account names or numbers along with their corresponding debit and credit balances. This format allows for easy sharing, printing, and viewing of the trial balance information.

A trial balance example is a financial statement that lists all the general ledger accounts and their balances, showcasing the company’s debits and credits in a snapshot format.

To write a trial balance example, list all asset accounts on the debit side, followed by liability and equity accounts, and then list all revenue and expense accounts on the credit side.